Six ESG Highlights for 2026

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

There is no doubt that the agriculture industry is a vital sector of the global economy, providing food, clothing, and other essential products for people around the world. The industry has evolved significantly in recent years, with advancements in technology, increasing global demand due to population growth and urbanization, and growing concerns about sustainability and environmental impact.

However, on grounds, industry risks are obvious and come in different shapes and forms: weather-related events, fluctuations in commodity prices, and regulatory changes. On top of that, a lot of the farms are located in emerging markets, adding another layer of risk and uncertainties.

With the high volatility on one hand and the huge potential of the industry on the other (coupled with the unbearable heat outside) we decided to take a closer look at agriculture equipment manufacturers as a way to get exposure to the growth potential with lower volatility.

Secular growth for agriculture products is driven by three main factors – population growth, urbanization, and rising income for emerging economies.

The image above was taken from the Bridgewise Platform. This information may not be up-to-date.

Agriculture Industry: Key Trends to Monitor

Population growth: The world’s population is expected to grow to 9.7 billion by 2050, and this means an increasing demand for food and other agricultural products.

Urbanization: This trend is expected to continue, led by developing countries in Asia and Africa. According to the United Nations, the world’s urban population is expected to grow from 4.5 billion in 2021 to 6.7 billion by 2050. Urbanization changes the way we consume food, shifting towards more processed food, and requiring more resources to produce.

Innovation: The agriculture industry is continually evolving and adapting to new technologies and innovations. This includes precision farming techniques, genetic modification, and advanced machinery, all of which have the potential to improve crop yields and awareness of the environmental impact of agriculture.

Company in Focus: John Deere (DE)

John Deere is probably the strongest and most familiar brand in the agriculture equipment space. The company was founded in 1837 and has a market cap of $120 billion. The company is selling its products worldwide in 160 countries.

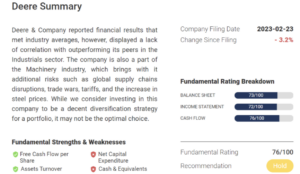

Taking a deep dive into John Deere’s fundamental analysis with BridgeWise reports reveals some interesting findings.

Though the final rating is a Hold, there are several areas of the business that scored very high. The Hold score is evenly distributed in the 3 main statements: Balance sheet, Cash Flow, and income statement.

The main positive highlights include Free Cash Flow per share, Asset Turnover, and the main negative highlights include net capex and cash and cash equivalents.

The image above is taken from the Bridgewise Platform. This information may not be up-to-date.

John Deere – Fundamental Score Highlights

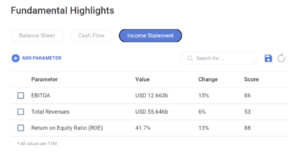

In this challenging macro environment, we continue to seek quality businesses that generate growth and returns throughout the economic cycle.

In the case of John Deere this is the case considering strong income statement metrics – ROE of 41.7% and EBITDA growth of 15% in 2022 were a standout both on a relative basis and versus peers.

Free cash flow was also a standout, receiving a very high score of 93. We value cash flow-generating business, especially in current times when external liquidity conditions are tight.

The company, according the Bridgewise’s analysis, scored poorly on CAPEX considering a 12% decline in 2022. The concern is that a reduction in CAPEX will negatively impact the future growth of the company.

The image above is taken from the Bridgewise Platform. This information may not be up-to-date.

Equity Research

Customized peer list

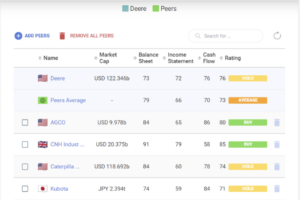

John Deere is classified in the Industrials sector, Machinery industry. However, with Bridgewise we can create an accurate peer list – companies around the world that deal directly with Agriculture equipment.

The image above is taken from the Bridgewise Platform. This information may not be up-to-date.

The customized peer list enables further research and analysis of the specific space or theme we wish to analyze and invest.

It is interesting to see an overall positive view of Bridgewise on the agriculture equipment space given the high number of Buy and Hold recommendations in this niche space.

Caterpillar, which also has a strong brand and similar market cap is also rated Hold, though its income statement score, an important metric for this segment, is significantly lower than John Deere’s.

AGCO for example is rated high though is at a significantly lower market cap tranche and also has a significantly lower income statement score.

Bridgewise enables us to continue and explore peer fundamentals in depth, regardless of the geography they operate or the exchange they are listed.

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

Generative AI has moved quickly from experimentation to production, but in financial services, ...

BridgeWise , the global leader in AI for investments, has today announced an international ...