Six ESG Highlights for 2026

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

Our preference for copper as a commodity stems from its advantageous supply versus demand dynamics and its substantial exposure to industries characterized by enduring growth trends.

Copper has experienced a notable upsurge in demand in recent years, primarily driven by its pivotal role in facilitating the decarbonization of energy systems. This heightened demand is anticipated to persist in the foreseeable future. As the global community transitions toward renewable power sources, a substantial quantity of copper is indispensable for the efficient distribution of electricity. Furthermore, the implementation of clean energy policies in the United States and Europe is intensifying the already heightened demand.

To illustrate, Electric Vehicles necessitate 2.5 times more copper compared to internal combustion engine vehicles, while solar and offshore wind energy requires two times and five times more copper per megawatt of installed capacity, respectively, compared to power generation from conventional sources.

According to a comprehensive report published by S&P Global, copper demand is projected to nearly double, reaching 50 million metric tons by 2035.

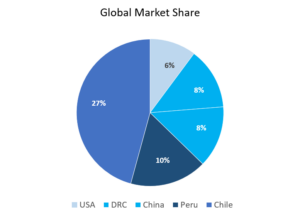

Despite the flourishing demand for copper, the global supply landscape encounters significant challenges. Notably, key copper-producing nations such as Chile, Peru, China, the Democratic Republic of Congo, and the United States collectively contribute nearly half of the world’s copper supply. The supply scenario is further constrained by geopolitical instability in these countries. For instance, Chile, the largest copper producer, faced a decline in production last year due to labor and water shortages, while political unrest in Peru, the second-largest producer, has also disrupted output. Moreover, it is crucial to acknowledge that the establishment of a copper mine typically requires a decade, adding further complexity to the supply outlook.

The intensifying competition among mining companies for limited resources is driving a growing sense of urgency. Consequently, mining companies are actively pursuing mergers and acquisitions as a strategic response to this challenge. Notable examples include Glencore’s bid for Teck, BHP’s acquisition of Oz Minerals, and Newmont’s purchase of Newcrest. These transactions exemplify the industry’s proactive efforts to secure future copper resources and strengthen its market position.

The mounting emphasis on Environmental, Social, and Governance (ESG) factors is compelling industry players to adopt sustainable practices. This includes reducing environmental impacts, promoting responsible resource extraction, and enhancing energy efficiency in mining operations.

The copper industry is reaping the benefits of technological advancements, which are enabling improved extraction efficiency, reduced energy consumption, and enhanced overall productivity.

Copper serves as an effective hedge against inflation, making it an attractive investment option. Moreover, copper offers favorable portfolio diversification due to its lower correlation with other assets.

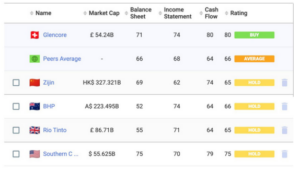

Considering the geographical locations of copper mines in regions impacted by geopolitical factors, diversification is strongly advised. To facilitate this process, Bridgewise has enabled us to identify and rank the top five copper miners, as depicted in the table below:

Glencore (LSE:GLEN) obtains the highest rating score, closely followed by Southern Copper

(NYSE:SCCO) .

Both Glencore and Southern Copper demonstrate notable strength in terms of their cash flow

scores.

Overall, there is a favorable distribution of scores. However, it is worth noting two areas of concern:

BHP’s (ASX:BHP) balance score of 52 and Antofagasta’s (LSE:ANTO) cash flow score of 59.

For detailed reading about fundamental trends, please click here.

Glencore, established in 1974, is widely recognized as the leading and most prominent brand in the copper mining sector.

With a market capitalization of $68.28 billion, the company operates across multiple continents including the Americas, Europe, Asia, Africa,

and Oceania. Glencore’s operations encompass the production, refinement, processing, storage, transportation, and marketing of metals, minerals, and energy products.

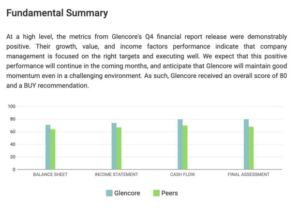

A comprehensive analysis conducted by BridgeWise reports provides valuable insights into Glencore’s fundamental performance.

While the overall rating for Glencore is a Buy, several areas of the business received exceptionally high scores. This Buy rating is evenly distributed among the three key financial statements: the Balance Sheet, Cash Flow, and Income Statement.

Notable positive highlights within Glencore’s performance include Total Assets and EBITDA.

However, there are some areas of concern, such as Net Capital Expenditure and Cash and Cash Equivalents, which receive negative highlights.

In the current challenging macroeconomic environment, our focus remains on identifying high-quality businesses capable of generating growth and returns across different economic cycles.

Glencore aligns with this objective, as evidenced by its robust income statement metrics. The company’s impressive Return on Equity (ROE) of 40.2% and remarkable EBITDA growth of 16% during this period position it favorably relative to peers.

Furthermore, Glencore’s exceptional performance in generating free cash flow, with a notable score of 85, is highly valued.

Particularly in the current tight external liquidity conditions, businesses with strong cash flow generation capabilities are highly regarded.

However, according to Bridgewise’s analysis, Glencore receives a poor score in terms of Capital Expenditure (CAPEX) due to a 14% decline during the examined period. The concern lies in the potential negative impact of reduced CAPEX on the company’s future growth prospects.

Glencore operates across various industries including automotive, power generation, battery manufacturing, steel, oil, and the broader natural resources sector. However, by leveraging Bridgewise’s capabilities, we can establish a precise peer list consisting of global companies directly involved in copper mining.

The customized peer list provides us with a valuable tool for conducting further research and analysis in the specific area or theme consumers intend to analyze and invest in.

It is noteworthy that Bridgewise holds an overall positive view on the copper mining sector, despite the prevalence of Hold recommendations within this niche space.

An interesting observation is that BHP, which shares a strong brand presence and a similar market capitalization with Glencore, is also rated as Hold.

Similarly, Southern Copper Company receives a Hold rating, despite its scores differing only slightly from Glencore’s.

With Bridgewise’s support, we can continue to delve into peer fundamentals in great detail, irrespective of the geographical locations in which they operate or the exchanges on which they are listed.

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

Generative AI has moved quickly from experimentation to production, but in financial services, ...

BridgeWise , the global leader in AI for investments, has today announced an international ...