Six ESG Highlights for 2026

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

The global alcohol industry is a vast and diverse market, with several key trends and players shaping its trajectory. The industry is primarily dominated by a few global multinational companies. Despite the challenging macroeconomic scenario, the sector offers interesting investment opportunities due to its strong brands, growth potential, and resilient demand for alcohol (what else can one do in such a challenging macro scenario).

The Alcohol Market

There are several factors contributing to the growth of the alcohol industry. These include the rise in disposable income in emerging markets, constant product innovation and brand extension opportunities, and a market ripe for consolidation and acquisitions.

The market encompasses the sales of beer, wine, and spirits, as well as related products such as mixers and non-alcoholic beer and wine.

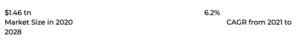

According to a report by Grand View Research, the global alcoholic beverages market size was valued at USD 1.46 trillion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2021 to 2028.

Within the alcohol segment, the spirits market size is estimated at $437 billion and remains the most profitable segment across the industry.

The alcohol industry is dominated by a small number of large players, and consolidation and mergers have been common in recent years. This trend is expected to continue as companies seek to expand their market share and diversify their product offerings.

One of the key consolidators in the industry is Diageo, a British multinational alcoholic beverages company that owns several major brands, including Johnnie Walker, Smirnoff, Baileys, and Guinness. It has been an active buyer of brands in recent years, with its latest acquisition being Don Papa Rum, completed in January 2023.

According to the Grand View Research:

The image above is taken from the Bridgewise Platform. This information may not be up-to-date.

Equity Research

Diageo (LSE:DGE)

Taking a deep dive into Diageo’s fundamental analysis with BridgeWise reports reveals some interesting findings. In the 4th quarter, the company published results that were quite positive, with a high score on both the balance sheet and income statement. However, cash flow scored relatively low, resulting in an overall Hold performance.

The summary report for DGE provides further insight into the company’s performance and financial health. Through BridgeWise’s AI-based stock analysis tool, investors can easily evaluate DGE’s fundamentals and make informed investment decisions.

Recent company events have mostly been labeled positive by Bridgewise, implying continued positive momentum in terms of business development. Both recent announcements – the continued search for acquisitions and the launch of Baileys’ mint version – are examples of the growth opportunities that the company and its product portfolio offer.

The acquisition of Don Papa is a good example of the M&A growth opportunities that the industry has to offer.

Income statement discussion

In this challenging macro environment, we are continuing to seek out quality businesses that generate growth and returns throughout the economic cycle. In the case of Diageo, we are observing strong EBITDA growth and high return factors, including a ROE of 38%.

According to Bridgewise’s algorithm, EBITDA and ROE are important factors for companies in this sector to deliver outperformance, and Diageo performs well in both areas.

Customized peer list

Diageo is classified under Beverages according to the Global Industry Classification Standard (GICS). The beverage industry is a part of the Consumer Staples sector, and its relevant businesses include Brewers, Distillers & Vintners, as well as producers of non-alcoholic beverages and soft drinks. For the purpose of this review, we will be focusing on the alcoholic beverages segment of the industry. As such, we will be customizing our peer list to reflect this.

As mentioned, we are more focused on spirits, as this is the most interesting part of the industry given growth and profitability metrics. However, looking at our peer list, Anheuser-Busch InBev received the highest score. The main product for the Belgian-Brazilian multinational beverage and brewing company is beer with its brands including Budweiser and Stella Artois.

Campari and Constellation brands are rated as underperforming.

We also chose to look at Becle, which owns the Cuervo Tequila brand and is traded on the Mexican stock exchange. Becle is rated Hold but its income statement score is high, implying positive revenue and profitability trends.

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

Generative AI has moved quickly from experimentation to production, but in financial services, ...

BridgeWise , the global leader in AI for investments, has today announced an international ...