Bridgewise Brings the Olympic Spirit to The Capital Markets

Tomorrow, athletes from all over the world will gather in Paris as the 2024 Summer Olympics begins with ...

By Ilan Furman, CFA

Iguatemi mall in Sao Paulo is famous for housing high end fashion brands with items selling for astronomical prices. Investing in the equities of these companies are an interesting way to get exposure to the pricing power of these brands.

High end fashion brands have been experiencing significant growth in recent years due to various factors. The luxury goods space proved to be resilient in the current macro environment: economic slowdown and inflationary environment. Resilience is a result of the brands’ strong pricing power and its premium clients’ with high disposable income.

One notable growth trend in luxury fashion is the increasing popularity of sports, leisure and active wear. These styles, which blend comfort and high-end fashion, have gained immense popularity in recent years and received a strong growth boost during the pandemic. Examples include Fendi, Fila, Dior, Nike, Prada and Adidas.

Another growth trend is the focus on sustainability and ethical fashion. Consumers are becoming more conscious about the source, production and environmental impact of their purchased items.

E-commerce has become a significant growth channel for high end fashion brands, allowing them to reach a wider audience and offer personalized shopping experiences. Social media platforms have also become important for brand promotion and engagement with consumers.

The Chinese consumer also plays an important role for the growth of these brands because China is the world’s largest market for luxury goods. Over the longer term, Morgan Stanley expects Chinese consumers to likely account for 60% of total spending growth for many of the high end brands.

More recently, high end fashion brands are using AI to support growth, operational efficiency, client relationship and many areas of the design. For example, Gucci and the entire LVMH group is starting to embrace different AI initiatives.

Investing in strong luxury brands, especially in the current macro environment, is interesting considering their brand recognition, pricing power, resilience in economic downturns, and growth potential.

The brand recognition and pricing power are quite significant barriers to entry, supporting the high profitability of these brands.

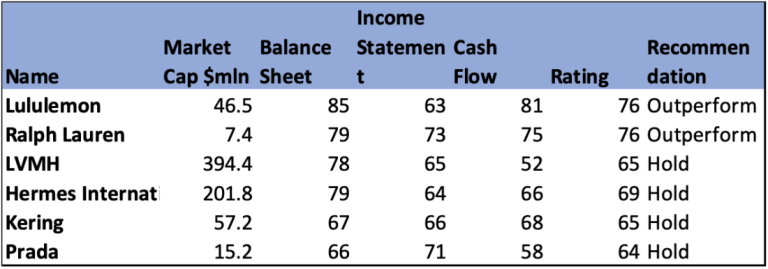

In line with the sportswear apparel trend in Luxury goods, Lululemon received an outperform rating and an overall score of 76.

The company focuses on yoga and athletic apparel, and its products often incorporate high-quality materials and innovative design features. The company was founded in 1998 and expanded rapidly to reach a global footprint.

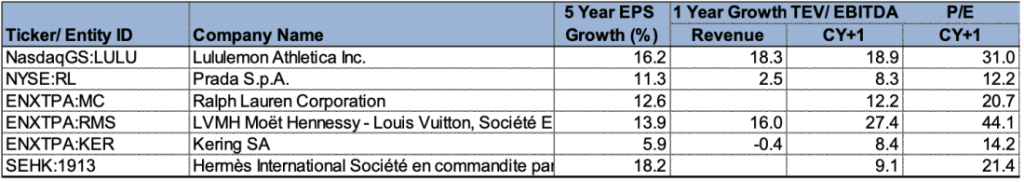

The company is not cheap, trading at a 30.6 times forward P/E. On the other hand, its expected growth of 18.5% is attractive and overall growth trends in the wellness space are expected to continue.

In its overall Bridgewise ratings considerations, Lululemon received outstanding ratings for both its balance sheet and cash flow performance: 81 and 85, respectively.

LVMH (Moët Hennessy Louis Vuitton SE): LVMH is a French luxury goods conglomerate with brands housing many shops in Igautemi shopping mall: Louis Vuitton, Christian Dior, Fendi, Celine and Givenchy.

LVMH received a Hold recommendation from Bridgewise, however, its balance sheet score is strong at 78. The company is a mega cap considering market cap of almost $400 billion. Looking at street estimates, the company is trading at a forward P/E multiple of 12.7

Ralph Lauren, the American fashion designer, also received an Outperform rating by the Bridgewise algrotihm and an overall score of 76. The company is best known for its “Polo Ralph Lauren” line, characterized by the polo player logo.

Ralph Lauren Corporation, established already in 1967, is a more mature brand. Expected growth for next year is quite low accompanied with an undemanding forward P/E multiple of 13.5 times.

Hermès, Kering and Prada are also present in Igautemi’s upscales malls and all received a Hold recommendation by Bridgewise.

Hermes is a French luxury goods company that is known for its iconic Birkin and Kelly bags, as well as its silk scarves and ties. Hermese balance sheet score of 79 is a highlight among the Hold recommended names in the list.

Prada, the Italian fashion brand, was founded in 1913 by Mario Prada. the Italian luxury fashion house. Prada is synonymous with luxury and high-end fashion. The brand is known for its sophisticated and high-quality clothing, accessories, and footwear.

Prada still grows revenues at a double digit rate and trades at a forward P/E of 22.0. Though a recommended Hold, the company received the lowest score in the selected group.

Kering, the French luxury goods company, has brands including Gucci, Yves Saint Laurent, Bottega Veneta, Balenciaga and Alexander McQueen.

More recently, high end fashion brands are using AI to support growth, operational efficiency, client relationship and many areas of the design. For example, Gucci and the entire LVMH group is starting to embrace different AI initiatives.

Investing in strong luxury brands, especially in the current macro environment, is interesting considering their brand recognition, pricing power, resilience in economic downturns, and growth potential.

The brand recognition and pricing power are quite significant barriers to entry, supporting the high profitability of these brands.

In line with the sportswear apparel trend in Luxury goods, Lululemon received an outperform rating and an overall score of 76.

The company focuses on yoga and athletic apparel, and its products often incorporate high-quality materials and innovative design features. The company was founded in 1998 and expanded rapidly to reach a global footprint.

Tomorrow, athletes from all over the world will gather in Paris as the 2024 Summer Olympics begins with ...