Six ESG Highlights for 2026

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

By Ilan Furman, CFA

Nubank, founded only in 2013, is today one of largest digital banks in Brazil. In the third quarter, the company’s client base reached 89.1 million. Nubank operates in Brazil (its largest operation), Mexico and Colombia.

Nubank’s third quarter earnings demonstrated the company’s long-term growth and profitability potential. Nubank meaningfully beat consensus estimates with Net Income of $303 million, almost 20% higher than street consensus. Return on Equity was high at 21%. The main driver for the beat was asset quality, with provision expenses coming lower than expected.

Nubank continued to grow strongly in the third quarter with loan growth of 91% and Net Interest Income growth of 127% on a year-on-year basis. As seen in the charts below, growth in the past few years has been phenomenal.

Nubank’s combination of growth and profitability demonstrates the operating leverage potential of digital banks versus traditional banks. The difference can be assessed through three key ratios used in the banking sector – Efficiency ratio, Net Interest Margin (NIM) and Return on Equity (ROE).

Efficiency ratio is calculated by dividing operating costs (OPEX) by Net Interest Income. Banks are a scalable business and if we think of the traditional banking model – growth was through recruiting more employees and opening more branches. Therefore, the marginal cost for banks’ growth is growing salary expenses for an additional employee. Though digital banks need more employees to support growth as well, the scalability and efficiency are significantly higher for digital banks as their operation is done online. This is already evident in Nubank’s numbers: Nubank’s efficiency ratio is way lower (about 20%) than its peers. Another ratio demonstrating Nubank’s structural improved efficiency is by number of employees per active client. According to this metric, Nubank’s employee is almost 20 times more efficient than incumbents.

Net Interest Margin (NIM) measures the spread between banks’ pay for deposits to charge on loans. NIM expresses the banks’ pricing power. Traditional banks benefit from a large client base and a perception of stability – therefore, their pricing power is stronger than new players. Creating market presence and brand recognition requires new entrants as the digital banks pay and charge less. This was true for NuBank a few years ago – aggressive client acquisition resulted in significantly lower NIM than its traditional banks peers. However, with time, Nu’s brand recognition increased, leading to a significant contraction in NIM versus peers.

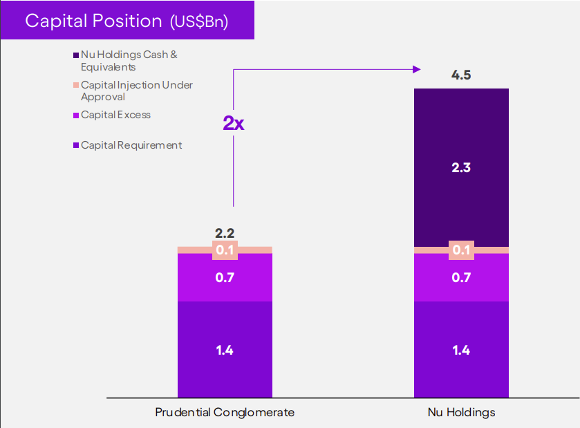

Return on Equity (ROE) this quarter was 21%, more or less inline with incumbents. However, NuBank still has loss making operations (Mexico and Colombia) and a very high capital position due to its recent IPO. With an equivalent capital position and larger scale at its subsidiaries, NuBanks’ ROE can double from current levels.

The chart below demonstrates Nu’s excess capital position:

Return on Equity (ROE) this quarter was 21%, more or less inline with incumbents. However, NuBank still has loss making operations (Mexico and Colombia) and a very high capital position due to its recent IPO. With an equivalent capital position and larger scale at its subsidiaries, NuBanks’ ROE can double from current levels.

The chart below demonstrates Nu’s excess capital position:

Return on Equity (ROE) this quarter was 21%, more or less inline with incumbents. However, NuBank still has loss making operations (Mexico and Colombia) and a very high capital position due to its recent IPO. With an equivalent capital position and larger scale at its subsidiaries, NuBanks’ ROE can double from current levels.

The chart below demonstrates Nu’s excess capital position:

This business model and its strong operating leverage potential can be simplified to the following chart:

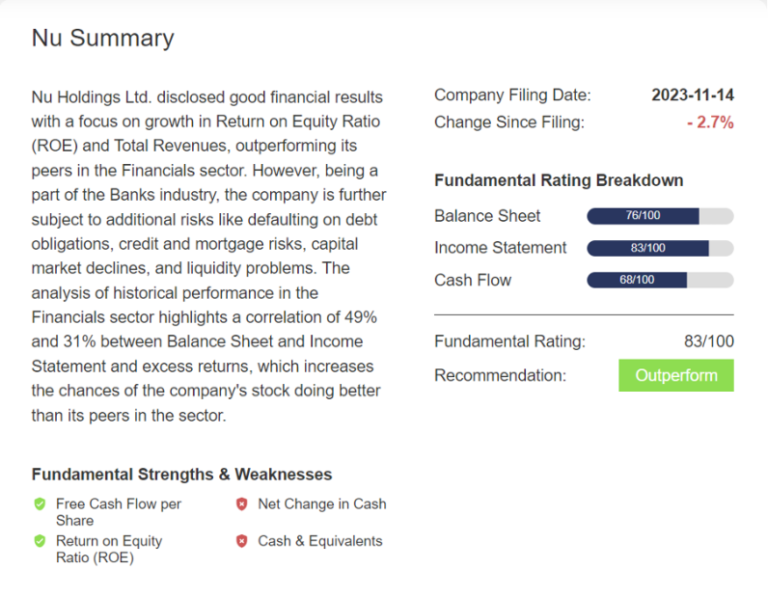

NubankHoldings: Bridgewise recommendation

Following Nubank’s quarterly performance, the company received an Outperform rating with an 82 score, the highest score among Brazilian banks.

The main highlight was the income statement of the bank, receiving a score of 83. Taking a deeper dive into the income statement, we can see return factor momentum receives an almost perfect score of 94. This can be explained by the massive improvement seen in Nubank’s ROE to 21%.

Other highlighted factors include Free Cash Flow Growth (97 score) and both Liabilities Movement and Assets change (87 score).

The score is higher than Brazil’s traditional banks – Itau (Hold with a 72 score) and Bradesco (Underperform with a 62 score).

Investing in strong luxury brands, especially in the current macro environment, is interesting considering their brand recognition, pricing power, resilience in economic downturns, and growth potential.

The brand recognition and pricing power are quite significant barriers to entry, supporting the high profitability of these brands.

In line with the sportswear apparel trend in Luxury goods, Lululemon received an outperform rating and an overall score of 76.

The company focuses on yoga and athletic apparel, and its products often incorporate high-quality materials and innovative design features. The company was founded in 1998 and expanded rapidly to reach a global footprint.

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

Generative AI has moved quickly from experimentation to production, but in financial services, ...

BridgeWise , the global leader in AI for investments, has today announced an international ...