Six ESG Highlights for 2026

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

The holiday season is here and the new year is just around the corner. But it’s not just your shopping list that deserves attention—your investment portfolio might, too. With holiday sales hitting a record $964.4 billion in 2023, it’s no wonder all signs point to another robust season ahead. A recent Morgan Stanley survey of 2,000 consumers reveals that about one-third plan to spend more this year, with only 22% intending to cut back. This optimism is already reflected in Thanksgiving sales, with Salesforce reporting $33.6 billion in global online sales—a 6% increase. This festive frenzy offers unique opportunities for investors to explore stocks poised to shine, from retail giants preparing for booming sales to travel companies gearing up for holiday rushes. But where to start? Meet Bridget, our AI-powered chat tool for investment intelligence.

Bridget is a key component of our mission to deliver data-driven investment intelligence to everyone worldwide. We believe that chat is a natural outgrowth of AI in finance, and will help deliver insights to investors in a natural and seamless way.

As we look at the holiday season, there’s no denying that some specific companies and sectors including travel, e-commerce, and retail enjoy a surge during this period. So we decided to ask Bridget about different stocks and sectors that will be impacted by the holidays.

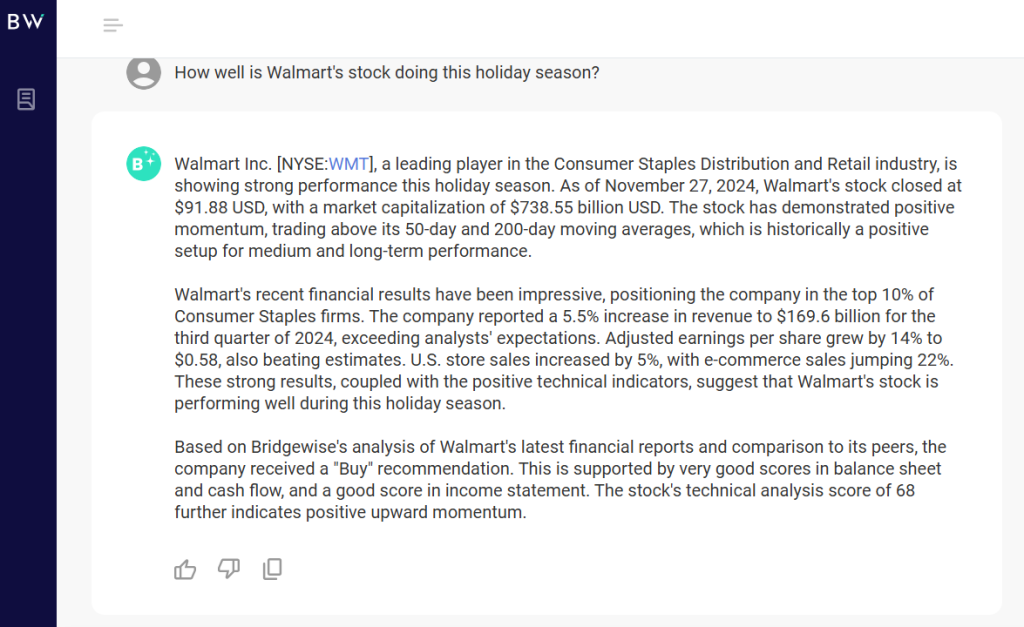

Walmart (WMT.N) is impossible to overlook during the holiday shopping season. With its annual sales and profit forecast raised for the third time this year, Walmart appears to be outpacing its main competitor, Target (TGT.N). According to Bridget, Walmart is a top contender this season, earning a “Buy” recommendation from Bridgewise’s analysis. “The stock’s technical analysis score of 68 signals strong upward momentum,” Bridget notes, making it a stock worth watching.

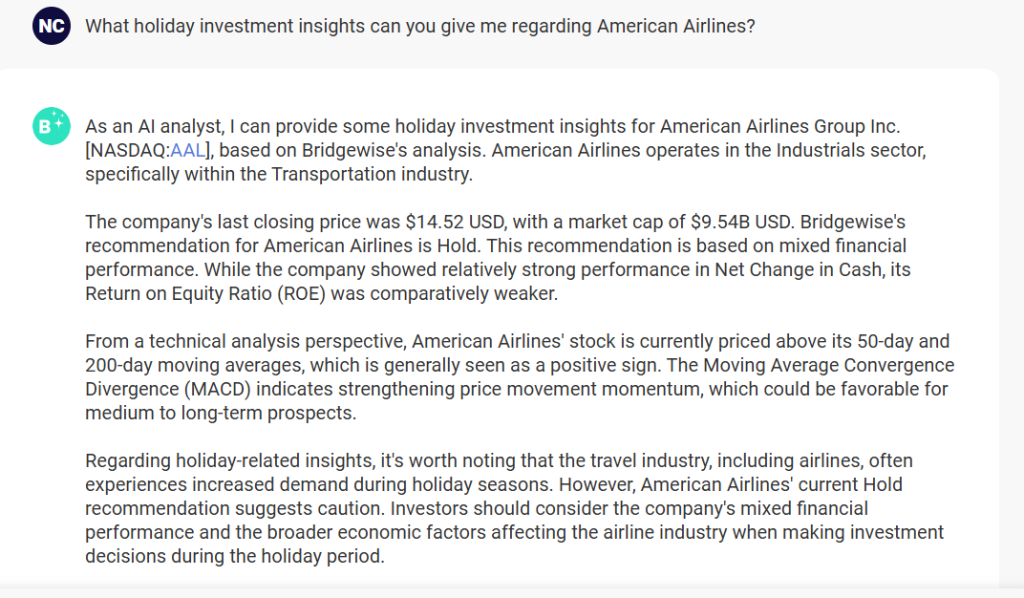

Surprisingly, despite being a key player in the bustling holiday travel industry, Bridget, along with Bridgewise’s analysis, advises caution when it comes to American Airlines Group Inc. (NASDAQ: AAL), giving it a “Hold” rating. While the stock shows positive technical signs, such as trading above its 50- and 200-day moving averages and strengthening momentum, its mixed financial performance, including a weaker Return on Equity (ROE), raises concerns. This highlights exactly why checking in with Bridget is so crucial for investors who want to stay ahead of the game. Without Bridget’s insights, one might naturally assume the stock is thriving simply due to seasonal demand, potentially overlooking key financial and market indicators.

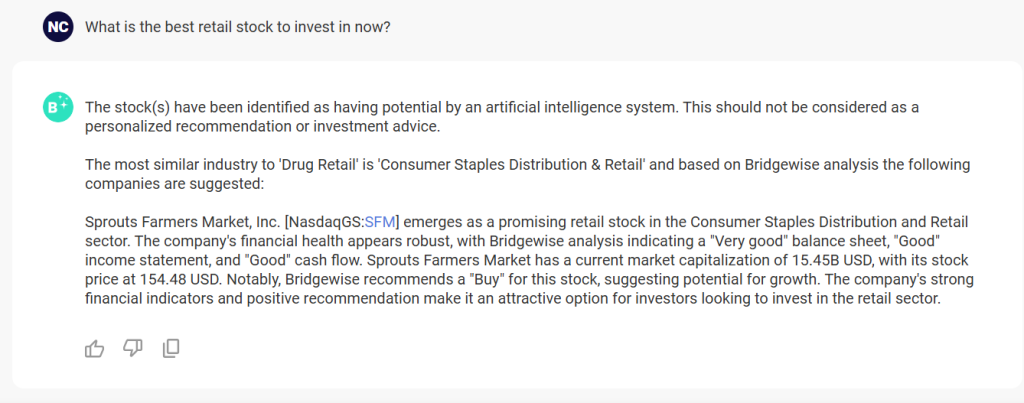

Sprouts Farmers Market, Inc. (NasdaqGS: SFM) stands out as a promising retail stock in the Consumer Staples Distribution and Retail sector, supported by Bridget’s insights. With a market capitalization of $15.45 billion and a stock price of $154.48, the company earns a “Buy” recommendation based on its robust financial health, including a “Very Good” balance sheet and “Good” ratings for its income statement and cash flow.

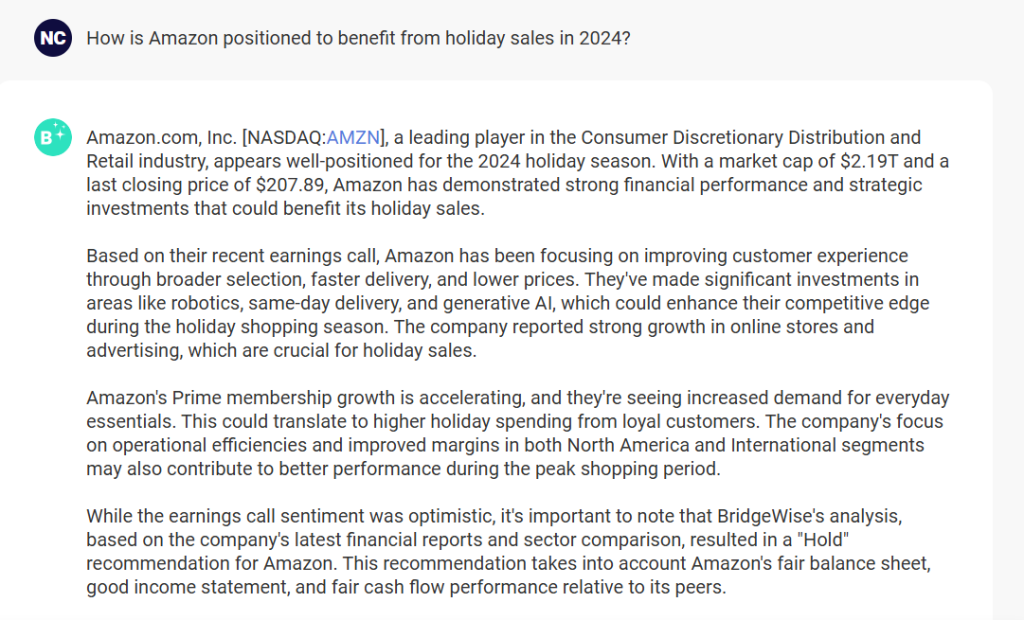

Following Amazon’s Prime Day October sales, the company is well-positioned for a strong 2024 holiday season. With a market cap of $2.19 trillion and a closing price of $207.89, Amazon continues to enhance customer experience through broader selection, faster delivery, and competitive pricing. Strategic investments in robotics, same-day delivery, and generative AI are set to boost efficiency during the peak shopping period. Prime membership growth and increased demand for essentials signal strong holiday spending from loyal customers, while improved margins in North America and international markets add to its potential. Despite these strengths, Bridgewise’s analysis gives Amazon a “Hold” rating, reflecting a fair balance sheet and cash flow performance relative to peers, emphasizing the need for a balanced evaluation of its holiday prospects.

As demonstrated in these examples, the transformative impact of AI in finance is undeniable. Leveraging an investment intelligence tool like Bridget provides investors with the critical edge to seize opportunities and confidently navigate financial risks. Ready to elevate your investment strategy? Get in touch with us today.

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

Generative AI has moved quickly from experimentation to production, but in financial services, ...

BridgeWise , the global leader in AI for investments, has today announced an international ...