Six ESG Highlights for 2026

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

By Dor Eligula, BridgeWise Chief Business Officer

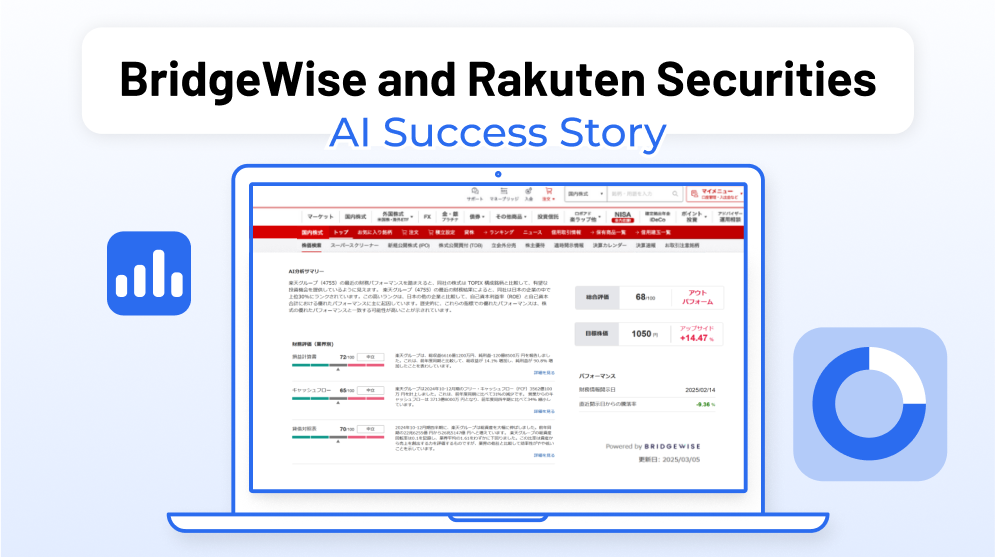

Last year, we announced the signing of a strategic partnership with Rakuten Securities to bring our AI-driven investment insights to millions of investors in Japan. On the surface, this partnership may not seem so different from others we’ve signed and announced. And yet, after celebrating the launch a couple of weeks ago, I feel deeply that our collaboration with Rakuten Securities is far more significant than many other milestones we’ve achieved here at BridgeWise.

First, it’s worth highlighting that the rollout of our solutions on their platform was met with an overwhelming response from their clients. In just the first 24 hours, Rakuten Securities users engaged with more than three million AI-generated reports, and we’ve seen that level of interaction continue to grow.

But in that success lies a deeper story of effort, adaptation, and collaboration. It has brought together two very different companies: BridgeWise, a relatively young startup operating at the edge of one of the most innovative areas of technology; and Rakuten Securities, a division of a massive multinational corporation and the leading trading platform in Japan. In partnership, we are able to move an entire industry forward, by delivering AI investment content to millions of users.

More than anything, it’s proof that AI is now a necessary source of wisdom, guidance, and information in capital markets and will be a critical part of the industry going forward. This moment was made possible by three key developments; not just for us at BridgeWise, and not only for our partners at Rakuten Securities, but also for the industry as a whole.

Since this post was originally published, our partnership with Rakuten Securities has continued to flourish. In their recent Q3 2025 earnings report, Rakuten Securities highlighted our partnership for the value it provides to their customers and for driving growth for the platform.

Rakuten Securities also identified BridgeWise AI as an enabler of investor decision making through the way it can help them resolve bottlenecks in their research process. The company pointed out that this enhanced decision making process has led to investors completing more transactions.

You can see the earnings presentation in the linked video below. The original version of this post continues underneath.

One thing that became clear as we began our conversations with Rakuten Securities was the level of execution and performance they expected; both from us as a partner and from our solution. It was, without question, the highest standard.

Japanese companies already operate, as a baseline, at an extremely high level. And when you factor in Rakuten Securities’ massive scale, global outlook, and the stringent requirements of local regulators alongside client expectations, we quickly understood that a typical startup mindset of “move fast and break things” wasn’t going to cut it.

That meant the time and effort we invested in this partnership, from the moment it was announced to the moment it launched, required significant commitment on our part. And I believe we are a stronger company because of it.

As the industry has evolved over the past few years, we’ve seen a parallel surge in the technologies and infrastructure that power generative AI solutions. This has raised a legitimate question: can AI startups really deliver at the scale required by major financial institutions?

Rakuten Securities supports over 12 million users. Any AI solution they adopt must be able to handle demand at that level.

Our ability to meet that scale, and the maturity of our platform that enables it, is yet another reason why this moment stands as proof that AI solutions have entered the mainstream of the financial industry.

Anytime a new and disruptive technology emerges, there is naturally some resistance among established players; whether they are directly threatened by the innovation or not. In financial services, this resistance is not only expected but necessary, due to the heavy regulatory burdens in place to protect investors.

In that environment, securing a partnership with Japan’s leading broker to deliver a generative AI solution carries an outsized impact. It breaks down a major barrier and serves as strong evidence that AI technology has matured to the point where even the most established incumbents are eager to blaze the trail.

Moreover, Japan is a beacon that other global, and especially APAC, markets look to for direction. This is especially relevant given the unique challenges APAC countries face, such as language diversity, and the ways in which AI can directly address these common problems.

If our partnership with Rakuten Securities proves the maturity of AI, not just in finance, but in the professional world more broadly, then the next question is: what does that maturity mean for end users?

One of the biggest questions hanging over the AI industry has been: What core value does AI actually deliver to users? Is it time savings? Better access to information? Even with platforms like ChatGPT becoming well established solutions, that question is still being answered across industries and use cases.

But in capital markets, we now have a compelling answer. The response from Rakuten Securities users speaks for itself: everyday investors are demanding insights. Not just for mega-cap stocks, but also for the long tail of global offerings. AI unlocks that universe of opportunities. Where information was lacking, AI provides clarity. Where investors were once intimidated, they now have a path forward and the confidence to take their financial futures into their own hands.

AI is delivering a new era of investments, and we are leading the charge.

Dor Eligula is the CBO and Co-founder of BridgeWise.

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

Generative AI has moved quickly from experimentation to production, but in financial services, ...

BridgeWise , the global leader in AI for investments, has today announced an international ...