Six ESG Highlights for 2026

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

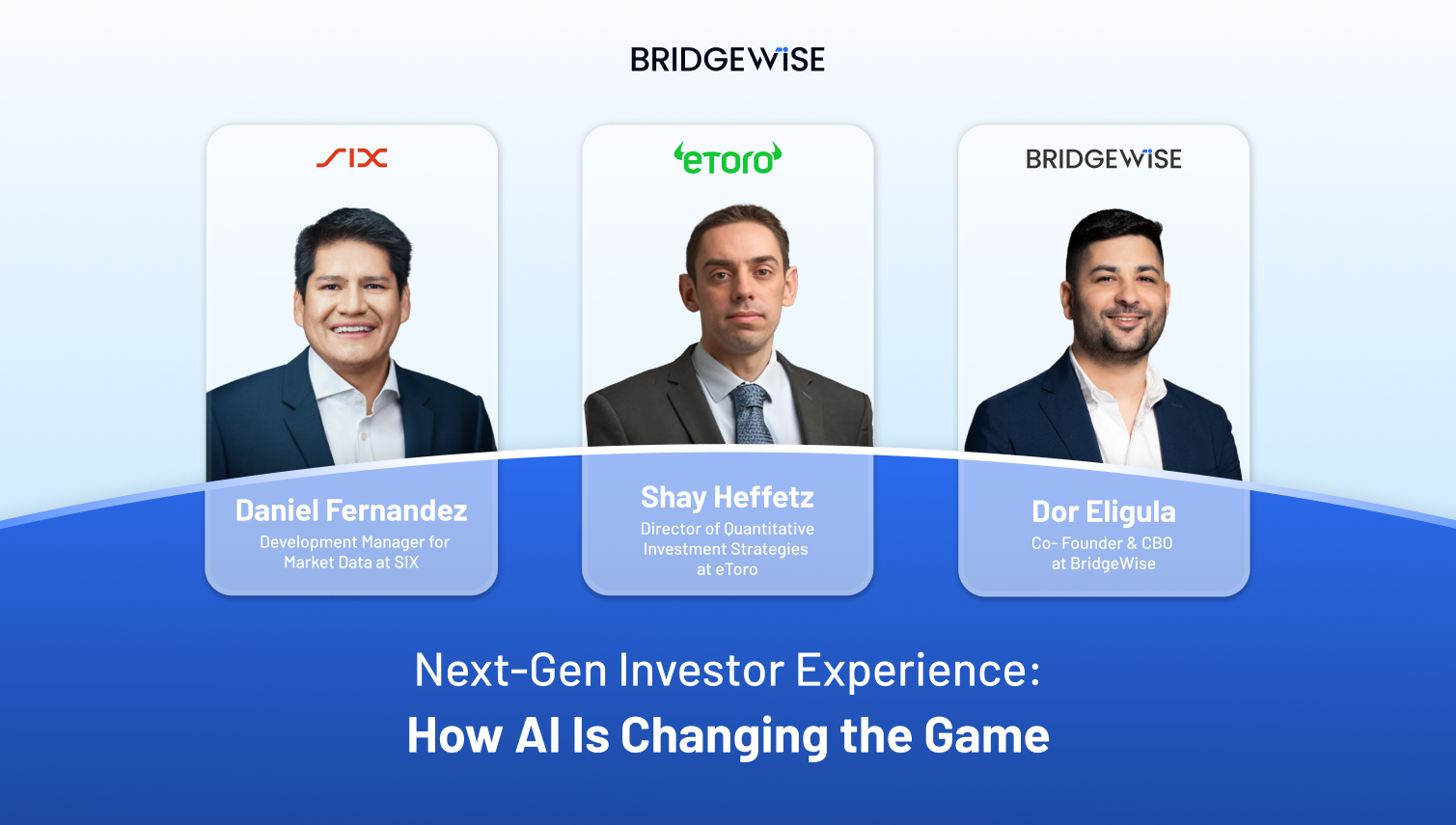

With the rise of ChatGPT and other AI platforms, expectations are growing for next-gen investor experiences that incorporate these solutions. To better understand what industry leaders are saying about this, we invited an expert panel to join us for Next-Gen Investor Experiences, part of our continuing webinar series. We hosted Daniel Fernandez, the head of business development market data at SIX Swiss Exchange, spoke with Shai Heffetz, the director of quantitative investment strategy at eToro, and Dor Eligula, co-founder and CBO of BridgeWise. Here are their main takeaway insights:

Shai Heffetz started off by explaining that, at first, there was a lack of trust in AI.

“The initial interactions were cautious, largely due to early limitations such as hallucinations in LLM and lack of up-to-date data. But recent advancements, especially the emergence of agentic AI, alongside real-time awareness and reasoning, have changed the game.”

Today, investors are experimenting with AI to build, refine, and monitor entire portfolios. It’s becoming a core part of their decision-making toolkit. Also, there is a definite contrast between generations.

According to Heffetz, “For the younger generation, regardless of their being a novice or experienced investor, we’re looking at roughly a 100% penetration rate of AI tools.”

Older generations show a lower and slower adoption rate, but it’s still there.

Eligula continued the conversation by describing the focus of brokers, trading platforms, and service providers in general on the engagement experience of their clients, which builds trust.

“Clients want their platforms to provide decision support tools for all of the activities they do on the platform. Retail investors want AI to provide simplicity and clarity when they make decisions, but still with an ability to dive deeper for specific information.”

One of the tools created by BridgeWise is the Bridget chat application, which uses assistive AI. How can this type of artificial intelligence aid with decision-making for investments? According to Eligula:

“In the past, you needed to query information via search engines. You had more friction compared to the chat experience, where you just shoot your question in natural language and get a fast answer. The level of effort an average investor would otherwise need to get these kinds of AI insights would take hours. Having it in the palm of your hand helps both the business and the client. The more empowered the user is, the more happy they are with the platform.”

But what about the balance between guidance and investor autonomy? As Heffetz explains:

“Our philosophy is to equip investors with powerful insights but never to replace their judgment. We make the service available and let the investor decide how and when to use it. If you’re allowing AI to make all the decisions, that’s not assistive AI. That’s taking over. Assistive AI is where there’s a human in the loop in one or more interactions.”

Next up was a discussion about institutional adoption. The common conception is that you can either build very quickly in-house, or outsource so another entity builds for you. When you’re speaking with institutions, what are the characteristics they are asking for?

Eligula responded:

“I see more companies going to the buy side versus developing something in-house for three reasons: speed, quality, and assurance. Clients cannot develop for months because, once they are done, the product will already be outdated. They need something that is turnkey, relatively speaking. Secondly, quality software requires a lot of resources but also expertise and time. Lastly, from an assurance perspective, the management team can say that outsourced software has been tried out by other organizations, on top of compliance and regulation factors.”

Heffetz’s experience in building AI models provides a similar viewpoint.

“The key question is – is this a core competency of my firm? If AI capability aligns closely with your long-term strategic differentiation, you will lean towards building it internally. But not if it’s a supporting function where a partner has clear domain leadership.

“Still, it’s not a binary decision. In many cases, you can blend approaches and deliver unique value at scale that others can’t easily replicate.”

The final question for the panel was about the next three to five years. What kind of client expectations will exist then?

Eligula answered: “Professional investors will use AI for heavy lifting. But, on the retail side, we’ll see a personalized AI experience. The interfaces we interact with today will automatically adjust to each investor’s needs. It’s not only automation and alerts and recommendations – it’s a whole conversation through AI.

“But this still leaves important room for the advisor. They will add a human touch as they will have a vital personal connection with the client.”

Heffetz echoed Dor’s vision. “Digital natives will expect AI to be embedded by default. They won’t ask for AI tools. But while AI will outperform many human advisors in areas like data processing, pattern recognition, and speed, human oversight remains crucial for judgment, empathy, and contextual understanding.

“What was once the privilege of the rich and wealthy to have a personalized investment manager that understands you, understands your circumstances, and provides you with customers and personalized advice, is now ready for the masses.”

For more details, watch the full webinar here. And, to learn about the future of AI-powered investing, we invite you to experience the BridgeWise demo.

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

Generative AI has moved quickly from experimentation to production, but in financial services, ...

BridgeWise , the global leader in AI for investments, has today announced an international ...