Bridgewise Brings the Olympic Spirit to The Capital Markets

Tomorrow, athletes from all over the world will gather in Paris as the 2024 Summer Olympics begins with ...

By Ilan Furman, CFA

Today we are reviewing high dividend stocks in Brazil. This is a lower risk alternative for equity investors. Involving dividend stocks in the portfolio has benefits as income steam generation, inflation hedge and lower volatility.

Brazil top down

Brazil’s equity market fell by 5% in the past month, though year to date performance is still positive at +16%. With inflation under control, there is potential for a meaningful easing cycle. This can lead to meaningful positive returns, both for equities and fixed income.

On August 2nd, Brazil’s central bank cut local rates (Selic) by 50 bps to 13.25%. Considering the expected inflation for the end of the year is 5%, Brazil still offers one of the highest real rates globally.

Several economists forecast Brazil’s interest rate can go down to 8% by the end of 2024. The main risk remains the global scenario, considering US rates continue to peak with US T-bills for example trading at 5.3%. This is a major challenge for the asset class.

Internal politics are always a risk but things seem to stabilize following the suggestion of fiscal reforms and better visibility of financial policy. The main specific internal risk for Brazil stocks to monitor is the potential impact of the suggested tax reform.

Dividend stocks overview

Given the expected volatile global scenario, high dividend paying stocks are an interesting investment option, considering dividend stocks are an efficient way to deal with two current main risks: market volatility and inflation.

Dividend paying stocks in general represent more established companies from an operational perspective. In order to pay regular dividends, these companies rely on steady cash flow from their operational activities and seek an optimal capital structure. As dividends are paid as a portion of a company’s net income, these need to be profitable to offer this kind of benefit. Therefore, diversifying the portfolio to dividend stocks will reduce its overall volatility.

From an inflation hedge perspective, dividend stocks are a good way to mitigate portfolio inflation risk as these are usually linked to inflation directly or indirectly. For example, utility companies have their contracts linked to inflation in a way that allows them to transfer its additional costs to the final consumer, which allows them to maintain the yield constant in real terms. The result is another benefit – a steady, inflation linked income stream to the portfolio.

Even though dividend companies are more established businesses, it doesn’t mean they don’t offer growth opportunities. For example, such companies may re-invest the portion that is not distributed and grow their business. Another source for potential capital gain is multiple re-rating, as offering a steady growing dividend stream over time is rewarded with multiple re-rating.

Opportunities in Brazil

Brazil’s equity market offers many dividend paying options given the index is biased towards established companies with high profits (banks, energy and commodity companies for example). The dividend yield of the EWZ for example is close to 5%.

The primary near-term concern revolves around the potential impact of the proposed tax reform on dividend-paying companies. On July 6th, 2023, the lower house of Brazil’s government passed legislation aimed at a comprehensive overhaul of the country’s tax laws. The most significant concern within this context is the possibility of implementing a tax on dividends, which poses a specific risk to dividend equities.

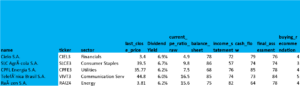

Bridgewise’s Expert Picks: 5 High-Yield Dividend Stocks in Focus

The following list includes names with a Buy / Hold recommendation by Bridgewise and a dividend yield higher than 5.5%.

CIELO – OUTPERFORM: One of the largest payment companies in the country in terms of market share is an outperform according to Bridgewise recommendation. With a significant market share, boasting an impressive dividend yield exceeding 6% and a notably low P/E ratio of 5. However, the company contends with formidable competitive pressures stemming from increased market competition.

SLC Agricola – HOLD: Operating on an extensive agricultural estate, this company engages in the production and global sale of various agricultural products, including soybean, corn, cotton, wheat, and more. It presents an appealing 6% yield and maintains a P/E ratio in the single digits. However, a notable risk factor lies in the potential volatility of soft commodity prices.

CPFL – OUTPERFORM: the Brazilian utility firm, receives a 79/100 fundamental rating from Bridgewise, with an attractive dividend yield of 6.2% and an impressive cash flow score of 85.

TELEFONICA – OUTPERFORM: Bridgewise has given an “Outperform” rating to Telefonica, one of Brazil’s major mobile telecommunications providers, highlighting its exceptional balance sheet score of 85. The company maintains a stable business trajectory with reduced CAPEX requirements, enabling it to distribute appealing dividends to shareholders.

RAIZEN – OUTPERFORM: A Brazilian integrated energy conglomerate operating Shell gas stations nationwide, alongside the production of sugar, ethanol, and renewable energy. The company presents an enticing dividend yield of 6.2%.

For full reports on the discussed stocks and additional fundamental analysis from Bridgewise AI, see the links below:

Tomorrow, athletes from all over the world will gather in Paris as the 2024 Summer Olympics begins with ...