Six ESG Highlights for 2026

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

By: Mor Hazan, Chief product Officer at BridgeWise

In the past few years, one of the clearest shifts in retail investing has been the rise of thematic strategies. Between 2020 and 2022, global assets in funds tied to themes such as renewable energy, clean technology, and disruptive innovation more than doubled. Investors were no longer approaching platforms with ticker symbols in mind, they were looking for ideas like “green energy” or “digital transformation.”

The same behavior appeared again in 2023 during the boom in artificial intelligence stocks. Instead of starting with individual names, investors clustered around broad themes – AI, machine learning, automation — and built portfolios that reflected those narratives.

The pattern is consistent: investors increasingly discover opportunities through themes, not static sector lists. For retail platforms, this represents both a challenge and an opportunity: how to make discovery feel more intuitive, while keeping it flexible enough to adapt as interests evolve.

That’s the backdrop for the launch of ThemeWise, powered by TagWise.

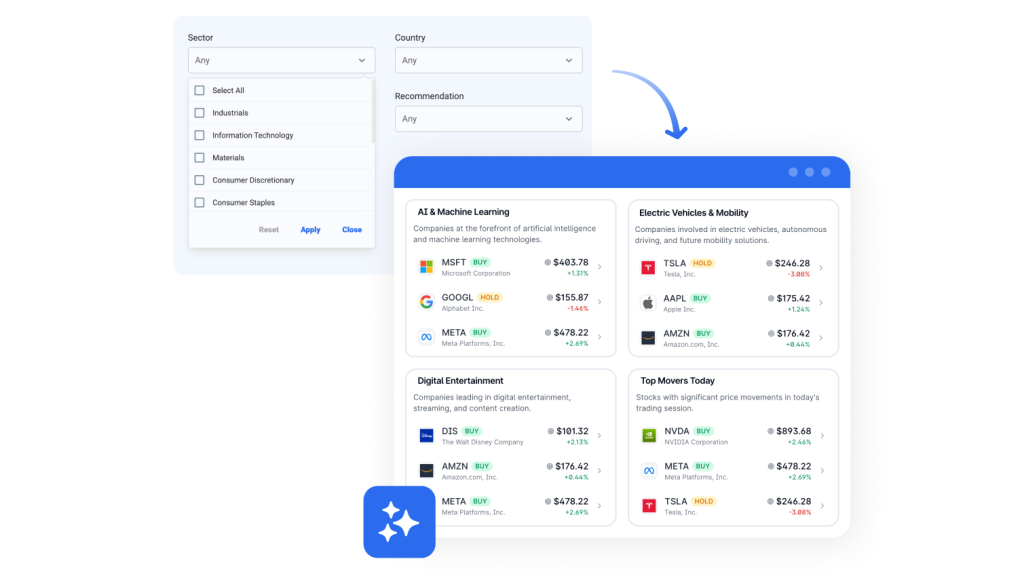

Most platforms today rely on three main mechanisms when it comes to asset discovery: search bars, sector categories, and trending tickers. These are functional, but they rarely provide investors with a sense of clarity or inspiration.

The reality is that discovery doesn’t need to be reinvented; it needs to be developed further. Investors have become accustomed to thematic, personalized interfaces in their day-to-day digital lives. When they enter a trading platform and find only broad, generic categories, the gap is noticeable.

For novice investors, this gap creates friction. For experienced investors, it reduces engagement. For platforms, it leaves valuable insight on investor interests untapped.

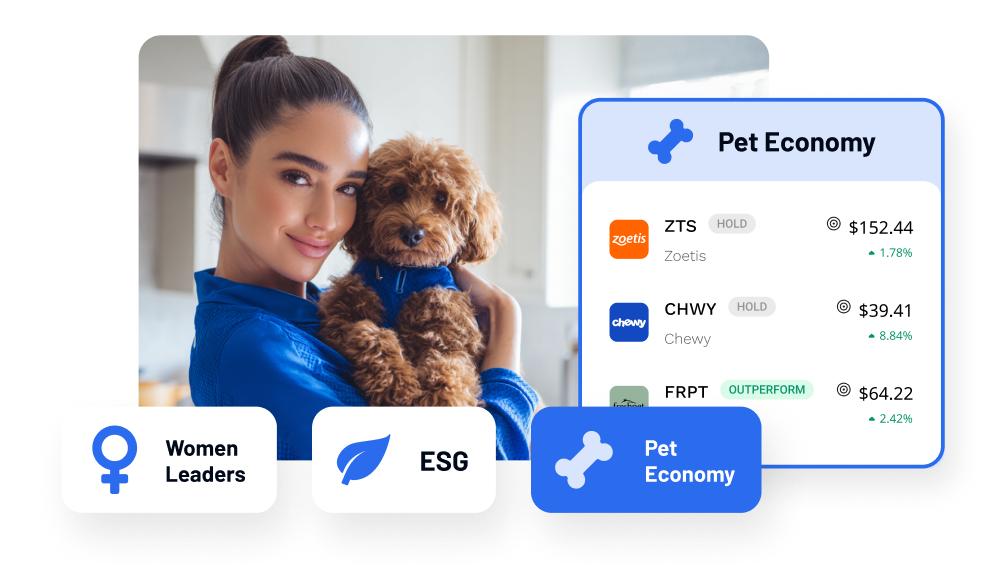

ThemeWise is designed to meet this need. It surfaces investment opportunities based on themes — from major global trends to niche areas of interest — and makes discovery more intuitive for investors at every level.

At its core, ThemeWise is powered by TagWise, a backend tagging tool that allows institutions to customize their thematic universe by selecting themes from BridgeWise’s broad range of thematic tags. Unlike rigid taxonomies, TagWise is dynamic and adaptable. Institutions can define the themes that align with their strategy, update them as trends evolve, and even localize them for specific markets.

Together, the two deliver a balanced value proposition:

Many AI-driven solutions risk adding complexity without clear value. ThemeWise and TagWise take a pragmatic approach by enhancing the moment every investor encounters most: asset discovery:

It’s important to frame discovery in context. It is not the entire investor experience, but it plays a specific role that ripples across the journey:

By improving discovery, you don’t transform the entire journey overnight. But you do strengthen the point where exploration turns into action.

The shift toward thematic investing is unlikely to reverse. Whether the next catalyst is renewable energy, artificial intelligence, or another emerging sector, investors are consistently choosing to frame their portfolios around narratives.

At the same time, financial institutions remain cautious. They need solutions that deliver meaningful experiences without creating regulatory or operational risk. ThemeWise and TagWise address both sides of the equation: a modern investor-facing experience backed by a flexible, institution-ready system.

The launch of ThemeWise and TagWise is about enhancing a critical moment in the investor journey: discovery. It’s the point where ideas spark curiosity, engagement begins, and decisions start to take shape. By improving this touchpoint, platforms can make investing more intuitive, relevant, and engaging.

For banks and trading platforms, this represents a practical step forward: helping advisors and investors connect with the themes that matter most, from Electric Vehicles and the Pet Economy to AI and Sustainable Investing. Asset discovery may not grab headlines, but getting it right drives confidence, sparks engagement, and provides actionable insights.

With ThemeWise and TagWise, we’re delivering a smarter approach: not a revolution, but a meaningful evolution, one that respects both the investor’s need for intuitive entry points and the institution’s need for flexibility and understanding.

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

Generative AI has moved quickly from experimentation to production, but in financial services, ...

BridgeWise , the global leader in AI for investments, has today announced an international ...