Bridgewise Brings the Olympic Spirit to The Capital Markets

Tomorrow, athletes from all over the world will gather in Paris as the 2024 Summer Olympics begins with ...

By Shay Shvartz, Senior Equity Research Analyst

In 1954, legendary Japanese filmmaker Akira Kurosawa released what will turn to be one of the most famous and influential films of all time – Seven Samurai. Six years later, in 1960, the American version of that film was released, but with a twist to its name – called The Magnificent Seven. While Kurasawa’s film was about a village of farmers who hire seven samurai to protect them from bandits, the American remake was a Western style movie, where seven gunfighters were hired to protect a small Mexican village, also from a group of bandits. Although the The Magnificent Seven was a successful movie in the United States, Seven Samurai is often cited as one of the greatest films in the history of cinema.

In the stock market, however, the balance of power is quite different. The U.S. stock market has been the central stage over the last few decades, with the main benchmark, the S&P 500, providing investors with a nominal return of 9.9% per annum, on average, since 1928 (or 6.6% per annum in real returns), while flirting these days with a new all-time high above 5,000 points. On the other hand, the Japanese stock market, represented by the Nikkei 225 benchmark, peaked on December 29, 1989 at 38,957.44 points only to be followed by Japan’s economic bubble burst. Since then, any investment in that index has been considered a “dead money”, as the index hasn’t reached again the all-time peak for more than 34 years in what many investors frame as Japan’s “lost decades”.

Speaking of the U.S. stock market, like those movies from the 1950’s, investors are looking for new “gauchos” to lead the herd and drive the major indexes to new all-time highs. Whether they were called The Seven Sisters (1940s-1970s), The Nifty Fifty (1960s-1970s), The Dogs of the Dow (1990s) or The FAANG (Since 2013), there was always a group of stocks that captivated investors with their abnormal returns and high profile. Almost 70 years after Kurosawa’s masterpiece, The Magnificent Seven came back to life, only that this time, to resemble the seven hottest stocks on Wall Street these days: Microsoft (MSFT), Apple (AAPL), Alphabet (GOOGL), Amazon (AMZN), Facebook (META), NVIDIA (NVDA) and Tesla (TSLA). Each one of them is considered a powerhouse in its industry, with market caps that exceed the GDP of many countries.

Accounting together for almost 30% of the market cap of the S&P 500 constituents, those seven stocks gained almost 73.9% in 2023, versus 24.2% of the S&P500 and only 12.6% of all other U.S. stocks excluding The Magnificent Seven.

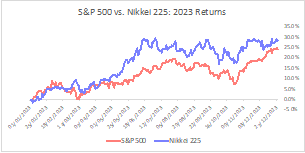

However, and maybe much more under the radar, the emergence of the Japanese stock market as an attractive investment has gathered momentum, as the Nikkei 225 index outperformed the S&P 500 both in 2022 and 2023, losing 9.4% in 2022 (versus the S&P’s 19.4% loss) and gaining 28.2% in 2023 (versus the S&P’s 24.2% gain). After almost three months into 2024, the Nikkei 225 has gained 14.6% year-to-date, while the S&P 500 is lagging way behind with only 4.3% return. Moreover, few days ago the Nikkei 225 reached a 34-year high and is on track to revisit its all-time record from 1989.

S&P 500 vs. Nikkei 225: 2023 Returns

S&P 500 vs. Nikkei 225: Year-to-Date Returns

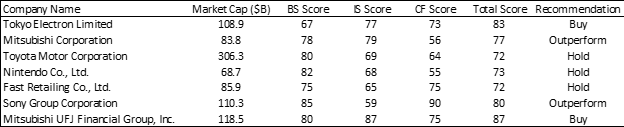

As many investors are focusing on the U.S.-based Magnificent Seven stocks, perhaps the Nikkei 225 roaring comeback should bring investors to consider other options to diversify their portfolios. In other words, investors might want to look not only at the Magnificent Seven, but also at the old-time siblings, The Seven Samurai. The following Samurais all have a market cap of at least $50 billion, making them the largest public companies in Japan, and they represent various industries. All of them also pay dividends, adding cherries on top of their staggering trailing twelve months performance. These are Japan’s Seven Samurai:

Tokyo Electron Limited (TSE:8035): The leading provider of wafer fabrication equipment, that is required for the production of semiconductor devices, released its latest financial results few weeks ago, and reported the first gross profit increase in five quarters and a major improvement in its gross margin. On top of that, the company called for what is looking like a bottom in capital expenditures for chip-making equipment and upgraded its outlook due to strong demand from China and for AI servers. Speaking of China, technological competition between the U.S. and China has led the former, alongside it allies Japan and the Netherlands to put restrictions on the sale of chips and chipmaking equipment to China. As a result, Chinese chipmakers have switched to legacy technologies that are not subject to those restrictions, a boon for a company like Tokyo Electron that sells to Chinese costumers its less advanced line of products. Tokyo Electron received a Buy rating by the Bridgewise algorithm and an overall score of 83. The company’s stock has gained 131.8% over the trailing twelve months and is currently trading at an LTM P/E multiple of 45.5x, at the high end of its peers ASML (44.0x), Lam Research (35.8x) and KLA (33.6x).

Mitsubishi Corporation (TSE:8058): Japan’s largest “Sogo Shosha”, or “general trading company”, has got in recent years an important stamp of approval from legendary investor Warren Buffet, who initially bought, through his holding company Berkshire Hathaway, a 5% stake in Mitsubishi in August 2020 and recently increased it to approximately 8%. Mitsubishi reported its latest earnings in early February, and announced a massive $3.4 billion of stock buyback, the largest ever for the company. Moreover, the company boasts an excess cash of $3.4 billion, which if not used for M&As or other growth initiatives, will also be distributed to shareholder. Even though Mitsubishi’s stock has almost tripled since Buffet’s investment, the company is still trading at an LTM P/E multiple of 14.8x, below the Nikkei 225 average P/E multiple of 20.5x. Mitsubishi is a diversified trading house, with ten revenue streams, the dominant ones being petroleum products, chemicals and minerals. Mitsubishi’s stock has gained 104.7% over the trailing twelve months, and it received an Outperform rating by the Bridgewise algorithm and an overall score of 77.

Toyota Motor Corporation (TSE: 7203): The second largest car company in the world in terms of revenues (behind Volkswagen) and the largest car company in world in terms of units’ sales (with 11.2 million units sold in 2023), also reported in early February 2024 its financial results and reported revenue growth of 23%, gross profit growth of 42% and net income growth of 85%, all on an YoY basis. The Japanese auto maker raised its full year sales projection to $294 billion (from an earlier estimate of $290 billion) and its profit forecast to $30 billion (from an earlier forecast of $27 billion). Toyota’s LTM gross margin stood at 19.9%, the company’s best gross margin since 2016. Toyota is trading at an LTM P/E multiple of 10.3x, a significant premium relative to legacy western automakers such as Mercedes-Benz (4.8x), Volkswagen (4.3x) or General Motors (5.3x), but is trading at a significant discount to electric vehicles automakers such as Tesla (46.5x), BYD (17.6x) or Geely (14.9x). Toyota received a Hold rating by the Bridgewise algorithm and an overall score of 72. However, Toyota boasts a strong balance sheet score of 80 its, fueled improved leverage ratios against it peers. For example, Toyota’s Debt/Equity ratio of 101.3% is much lower than peers such as Mercedes-Benz (118.5%), Volkswagen (121.2%), General Motors (179.9%). Toyota’s stock generated an 86.1% return over the trailing twelve months.

Nintendo Co., Ltd. (TSE: 7974): The entertainment giant announced its third quarter results in early February 2024 and raised its outlook for the Switch console sales for the current fiscal year (which will end on March 31, 2024). The company expects to sell 15.5 million consoles (versus the previous outlook for 15 million). Nintendo also raised its revenue and net income outlook to $10.9 billion and $2.9 billion, respectively, driven by the major success of the Super Mario Bros. Wonder launch in September 2023, selling 4.3 units withing the first two weeks (and 12 million units by the end of December 2023), making it the fastest-selling Super Mario game. Another driver has been the action-adventure game The Legend of Zelda: Tears of the Kingdom, which was released in May 2023 and is currently the second-best selling Zelda game of all time, with more than 20 million units sold by the end of December 2023. Nintendo is also benefiting from the weakening Japanese Yen, which depreciated by approximately 11.7% against the U.S. dollar over the last 12 months. Nintendo received a Hold rating by the Bridgewise algorithm and an overall score of 73, marked by a strong balance sheet score 82, representing Nintendo’s pristine balance sheet, which is debt-free and sits on significant piles of cash and short-term investments ($14.2 billion) which account for 65% of Nintendo total balance sheet. The company’s stock has gained 58.4% over the last 12 months, but it’s important to follow any news regarding the launch of its new Switch console, which was expected to launch during the holiday season of 2024, but recent reports suggest that the launch of the Switch 2 gaming console may be delayed until the early months of 2025. Nintendo is trading at an LTM P/E multiple of 19.7x, and its dividend yield is 2.3%.

Fast Retailing Co., Ltd. (TSE: 9983): The apparel retailer which is more known as the owner of the famous Uniqlo brand has positioned itself as a producer of basic, mass appeal clothes. Strong global sales have been the key to the company’s momentum recently; while revenue growth within Japan has been quite moderate around 4% during the last fiscal quarter, international revenue growth has been much stornger, with North America revenue growing by 22%, Europe revenue growing by 34%, and China revenue growing by 23%, all on a YoY basis. International sales account for a growing share of Fast Retailing revenues, around 40%, versus roughly 30% few years ago. The company is planning to continue and expand its overseas footprint, by opening 20 new stores in North America in 2024, on top of the 72 existing ones, aiming to reach 200 stores by 2027. In addition, Fast Retailing is planning to open 80 new stores in China in 2024, aiming to reach more than a thousand stores there by the end of 2024. Fast Retailing received a Hold rating by the Bridgewise algorithm and an overall score of 72, marked by its strong balance sheet which includes approximately $10.2 billion of cash and short-term investments (roughly 44% of total balance sheet) against a mere debt of $4.8 billion, on top of a healthy cash flow generation, represented by a 46% cash flow from operations CAGR over the last 5 years. Fast Retailing is trading at an LTM P/E multiple of 40.5x, a significant premium to its fast fashion peers H&M (26.4x) and Zara’s owner Inditex (24.0x), and to the average P/E multiple of the Nikkei 225 benchmark (20.5x). The Uniqlo brand owner stock has gained 54.9% over the trailing twelve months.

Sony Group Corporation (TSE: 6758): The Tokyo-based gaming giant also announced recently its third quarter financial results, for the period that encompassed the holiday season between October and December 2023, traditionally the strongest quarter for Sony. The company reported strong results, with most of its business segments demonstrating mid-teens growth. Top and bottom lines growth has been 22% and 13%, respectively. In addition, Sony revised its full-year net income outlook, raising it by 5%. From volumes perspective, the company sold 8.2 million PS5 consoles during the last quarter, roughly 15% increase on a YoY basis, yet below the company’s expectations, leading it to trim its full year forecast for the PS5 console sales from 25 million units to 21 million units. Although Sony admitted that its PS5 console is entering its “latter half of the console cycle”, and that units’ sales will start to decline starting its next fiscal year, the company stated that it aims to focus on profitability by selling the consoles without substantial discounts. On top of that, Sony owns some the most talented studios in the gaming industry, developing games that are exclusive to the PlayStation platform. Two of them, Insomniac Games and Santa Monica Studio published two blockbusters during the last 18 months, Spider-Man 2 (October 2023) and God of War Ragnarok (November 2022), both making a major contribution to Sony’s profits. Moreover, Sony is benefitting from the depreciation of the Yen across all of its business segments, as the company is positioning itself as a well-diversified global media/tech giant. Sony received an Outperform rating by the Bridgewise algorithm and an overall score of 80, marked by its strong cash flow generation, as the company reported $5.8 billion in cash flow from operations, one of its best-ever quarters from that perspective, propelling its stock to gain 18.1% over the trailing twelve months.

Mitsubishi UFJ Financial Group, Inc. (TSE: 8306): Japan’s largest bank, also known as “MUFG”, reported in early February strong financial results, with quarterly net income soaring 230% on a YoY basis. Although the previous year’s net income was negatively impacted by a one-off expense related to the sale of a U.S. banking unit, MUFG also managed to increase its net income due to lower losses on debt securities and loans. The company is also set to surpass its fiscal year revenue target of 1.3 trillion Yen, as it already generated 1.29 trillion Yen, or 99.8% of its target, during the first nine months. There is also a consensus building that the Bank of Japan will abandon its negative interest rate policy (currently at minus 0.1%) in 2024 due to persisent inflation, and that the banks’ earnings environment will improve as lenders like MUFG will pass on to their borrowers any increases in domestic interest rates. For 21 straight months Japan’s core CPI’s read has been higher than the BOJ’s stated target of 2.0%, supporting the hawkish monetary thesis. MUFG received a Buy rating by the Bridgewise algorithm and an overall score of 87. For foreign investors, an investment in MUFG, which also sports a dividend yield of 2.7%, may also hedge against an appreciation of the Yen which will hurt Japanese exporters, whether because of the Bank of Japan raising interest rates or because of the Federal Reserve cutting interest rates. MUFG’s stock has gained 56.7% over the trailing twelve months.

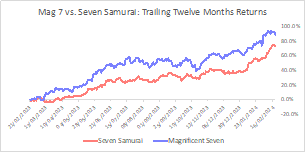

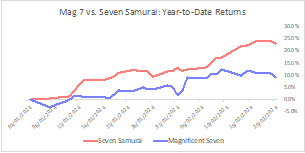

While The Magnificent Seven have outperformed The Seven Samurai on a trailing twelve months basis, gaining 89.0% versus only 73.0% of the Samurais, but so far in 2024 on a year-to-date basis the tide has dramatically shifted, with the Samurais significantly outperforming with a 23.1% gain, versus only 9.2% of The Magnificent Seven. In addition, while the average P/E multiple of the The Magnificent Seven is 45.9x and their average dividend yield is 0.2%, the Samurais trade at an average P/E multiple of only 23.1x, alongside an average dividend yield of 1.5%. As a result, investors who are wishing to diversify their portfolio with non-U.S. equities may consider options in “the land of the rising sun”, and more specificially, the rising Seven Samurai. Despite the fact that many western investors tend to focus mainly on U.S. equities, we believe it’s worth recalling the famous quote from Kurosawa’s epic movie: “Even bears come down from the mountains when they are hungry”. In other words, investors searching for alpha will no longer be able to ignore Japan’s stock market reemergence and its new Samurais.

Mag 7 vs. Seven Samurai: Trailing Twelve Months Returns

Mag 7 vs. Seven Samurai: Year-to-Date Returns

Tomorrow, athletes from all over the world will gather in Paris as the 2024 Summer Olympics begins with ...