Six ESG Highlights for 2026

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

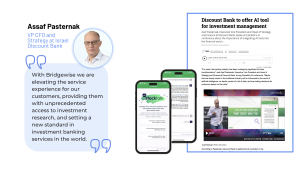

Israel Discount Bank is the third-largest bank in Israel, serving over one million customers with a comprehensive range of banking, capital market, and investment services.

Reinventing Retail Investment Services

The bank aimed to boost profitability in its retail segment by addressing the evolving needs of mainstream investors. Growing interest in international stocks highlighted the need for more robust advisory services, which were currently limited and focused on local stocks. Meanwhile, the demand for data-driven tools presented an opportunity to target a customer base ineligible for current investing offerings. Providing these customers with self-serve solutions could help the bank unlock untapped revenue streams from their existing client base.

Discount Bank needed to:

Transforming Discount Bank’s Offerings with AI-Powered Investment Intelligence

Discount Bank partnered with Bridgewise to integrate AI-powered tools across its offerings, transforming the retail investor experience.

Advisory Team:

Bridgewise’s AI tools enhanced the bank’s research system, improving advisory efficiency. Aligned with internal policies, AI-driven analysis & recommendations expanded equity coverage from 200 to 900 stocks.

Retail Platform:

The bank introduced EquityWise, an AI-powered tool providing easy-to-read equity analysis for all customers.

VIP Customers:

VIP clients accessed Bridget, an AI-powered chat service offering personalized, regulatory-compliant buy/sell recommendations and in-depth analysis, empowering more mature investors to make informed decisions in a self-directed manner.

By integrating Bridgewise’s AI solutions, Discount Bank modernized its services and became a leader in customer-centric investment intelligence. The bank was the first to redefine its offerings with Bridgewise’s full suite, and the strong engagement demonstrated significant interest in this service. It now plans to expand into a second asset class, ETFs.

Through its partnership with Bridgewise, Israel Discount Bank has successfully positioned itself as a pioneer in customer-centric investment intelligence. By leveraging AI-driven solutions, the bank has unlocked new revenue streams, enhanced the service experience, and empowered clients across all segments. This transformation not only meets the current needs of modern investors but also sets the foundation for continued innovation and expansion into new asset classes, ensuring sustained leadership in the financial services sector.

With 2026 in full swing, many people are working to get their plans for the year moving forward. For ...

Generative AI has moved quickly from experimentation to production, but in financial services, ...

BridgeWise , the global leader in AI for investments, has today announced an international ...