China’s Re-Opening: Positive Impact on Luxury Brands

After three years of stringent COVID control measures, China has finally reopened. This was one of the key themes discussed last month at TradeTech Paris.

Given the many governance issues with Chinese companies in recent years and the still somewhat complicated market access, one way to gain exposure to the theme is through global luxury brands.

Luxury brands include high-end fashion houses such as Chanel, Gucci, Louis Vuitton, and Prada, as well as high-end watchmakers such as Rolex and Cartier, and high-end automobile manufacturers such as Ferrari and Lamborghini.

The luxury brands industry has experienced significant growth in recent years, due in part to the growing number of affluent consumers around the world. The global luxury goods market is expected to reach a value of $445 billion by 2025.

The luxury fashion segment accounts for the largest share of the luxury goods market, and Chinese buyers dominate these brands, with China being the world’s largest market for luxury goods, accounting for nearly one-third of global sales.

According to Morgan Stanley estimates, the reopening of China will boost demand for luxury goods by 20% in 2023. Over the longer term, Morgan Stanley expects Chinese nationals to account for 60% of total spending growth on personal luxury goods.

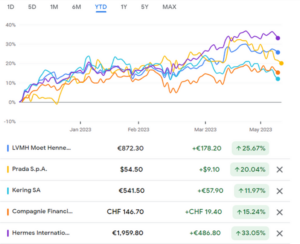

Taking a closer look at the five leading brands, stocks are already moving to reflect these expectations, with double-digit returns from the start of the year.

The luxury goods space has proven to be resilient in economic downturns, and in the current inflationary environment, it possesses high levels of pricing power.

Investing in luxury brands – other trends and appeal

The industry is also supported by the rise of e-commerce and digital marketing, which has allowed luxury brands to reach a wider audience and connect with consumers in new and innovative ways.

E-commerce is the fastest-growing channel for luxury sales, with online sales of luxury goods expected to reach $112 billion by 2025.

Investing in strong luxury brands, especially in the current macro environment, is interesting considering their brand recognition, pricing power, resilience in economic downturns, and growth potential.

The significant brand recognition and pricing power are barriers to entry, which support the high profitability of these brands.

Luxury brands – creating a mini universe with Bridgewise

We have chosen five leading companies to build our universe – a real brand celebration!

LVMH (Moët Hennessy Louis Vuitton SE), a French luxury goods conglomerate with brands including Louis Vuitton, Christian Dior, Fendi, Celine, and Givenchy. Hermès, a French luxury goods company known for its iconic Birkin and Kelly bags, as well as its silk scarves and ties. Prada, an Italian luxury fashion house. Richemont, a Swiss luxury goods group that owns several high-end brands, including Cartier, Van Cleef & Arpels, Piaget, Montblanc, and Dunhill. Kering, a French luxury goods company, with brands including Gucci, Yves Saint Laurent, Bottega Veneta, Balenciaga, and Alexander McQueen.

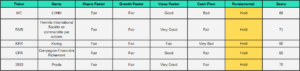

Considering the strong year-to-date rally, all companies in the selected universe are rated as Hold. LVMH, the largest company in terms of market capitalization, has a fundamental rating of “Hold” and an overall score of 66. Hermès has the highest score in the peer group of 71 and has also been rated as “Hold.” Kering and Richemont both have fundamental ratings of “Hold” and scores of 60 and 65, respectively. Prada has a higher score of 70 and also has a “Hold” rating.

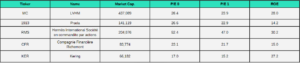

In the table below, it is interesting to see that even though these companies seem cheap when looking at traditional multiples like P/E, they all received a high or very high value score from Bridgewise. The high ROEs are a sign of the quality of their brands and their commercial strategy.

Click here to read the full reports: