CIO review – February 2024

By Ilan Furman, CFA

January – Equities Performance Round Up

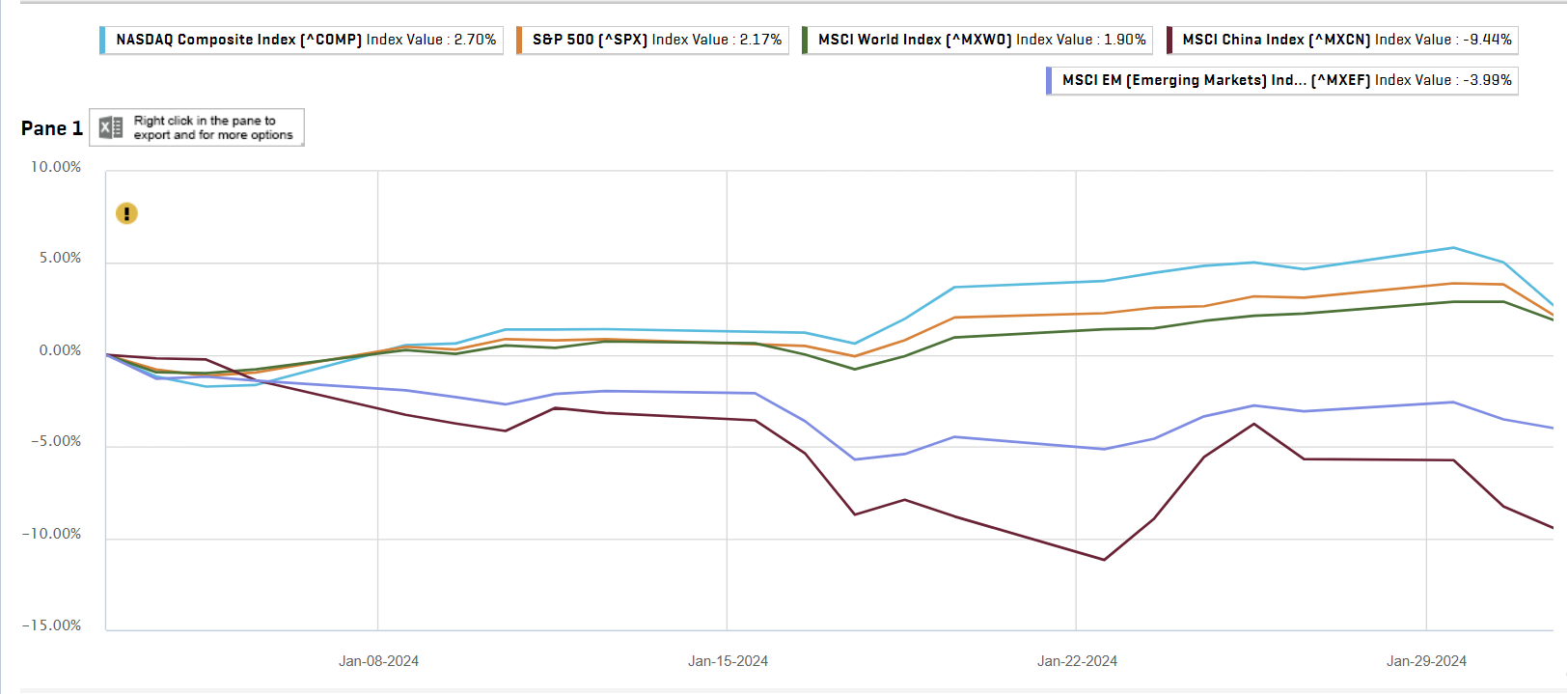

In January we saw main markets continuing the end of 2023 momentum with S&P, Nasdaq and MSCI world indexes, delivering positive returns.

Source: Capital IQ

Emerging markets significantly underperformed, down 4%, led by the sell off seen in Chinese equities, down 9.5% for the month. Chinese news flow continued to be negative and on January 29th, Evergrande, the Chinese property developer, was ordered to liquidate by Hong Kong courts. Earlier in the month foreign investors were disappointed as they were expecting announcements in Davos about a plan to boost the Chinese economy and its equity market.

Investors’ attention remains focused on the timing and scope of rate cuts by the US fed. In the midst of the Q4 earning season, corporate earnings and economic data are also very important, especially after the pick up seen in valuation levels. So far, US economic data, especially considering the situation at the job market (low unemployment at 3.7% and strong job creation), is positive and is likely to support US consumption and corporate earnings.

Monthly focus: Brazil Equities – top down review and an AI portfolio overview

In accordance with the insights shared in our January 2024 outlook publication, our attention remains steadfast on Brazil equities for the current year. This preference is underpinned by several compelling factors:

- Favorable Valuation Metrics: Brazil equities exhibit an attractive valuation, with a price-to-earnings ratio standing at a modest 8 times.

- Easing Rate Cycle: A notable aspect contributing to our optimism is the initiation of an easing rate cycle. This commencement, initiated from a high interest rate standpoint alongside low inflation levels, suggests substantial potential for significant rate cuts.

- Stable Fiscal and Political Landscape: Additionally, our confidence is bolstered by the relatively stable fiscal and political environment anticipated throughout 2024. Brazil, as opposed to 50% of the global population, is not facing an election in 2024.

Brazil’s expected macro scenario

Brazil’s projected GDP growth for 2024 stands at 1.8%, following a growth rate of 2.6% in 2023. Despite this growth, the economy continues to operate below its full potential, primarily attributable to persistent productivity challenges and infrastructure deficiencies.

Source: consensus economic forecasts

Following a peak of 13.75% in 2023, interest rates (Selic) were reduced to 11.75% by the year’s end. With inflation effectively managed and currently at 4.6%, Brazil maintains one of the world’s highest real interest rates. Anticipated further decline in inflation to 4% by the close of 2024 suggests considerable potential for interest rate reductions, a trend expected to provide favorable support for both equities and bonds.

Given Brazil’s spending tendencies, its fiscal position is always closely monitored by investors. Current debt to GDP ratio is 75%, though Brazil in recent years is passing reforms to stabilize its fiscal path.

At the end of last year an overhaul tax reform was passed. This is significant as it aims to simplify Brazil’s tax system, which is notorious for its complexity. For example, In 2019 the World Bank estimated that it took companies 1,501 hours a year to comply with Brazilian tax law, compared with a global average of 234. The main reason for the complexity is the power to levy consumption taxes by all government levels – federal, state and municipal. Considering that Brazil has a total of 27 states and 5,570 municipalities – complying with all tax laws is almost mission impossible.

Prior to that tax reform, in 2017 Brazil’s labor laws were modernized. More recently, in Bolsonaro’s term, a pension reform raising the retirement age was passed.

These reforms are increasing investors’ confidence in the sustainability of Brazil’s fiscal path.

Investors will continue to closely monitor Lula and Fernando Haddad’s fiscal policies.

Brazil strategy – Bridgewise AI powered portfolio

Bridgewise Brazil portfolio was constructed by running our proprietary algorithm on the Brazilian equities universe, and selecting the best performing ones based on a 5 year back testing period.

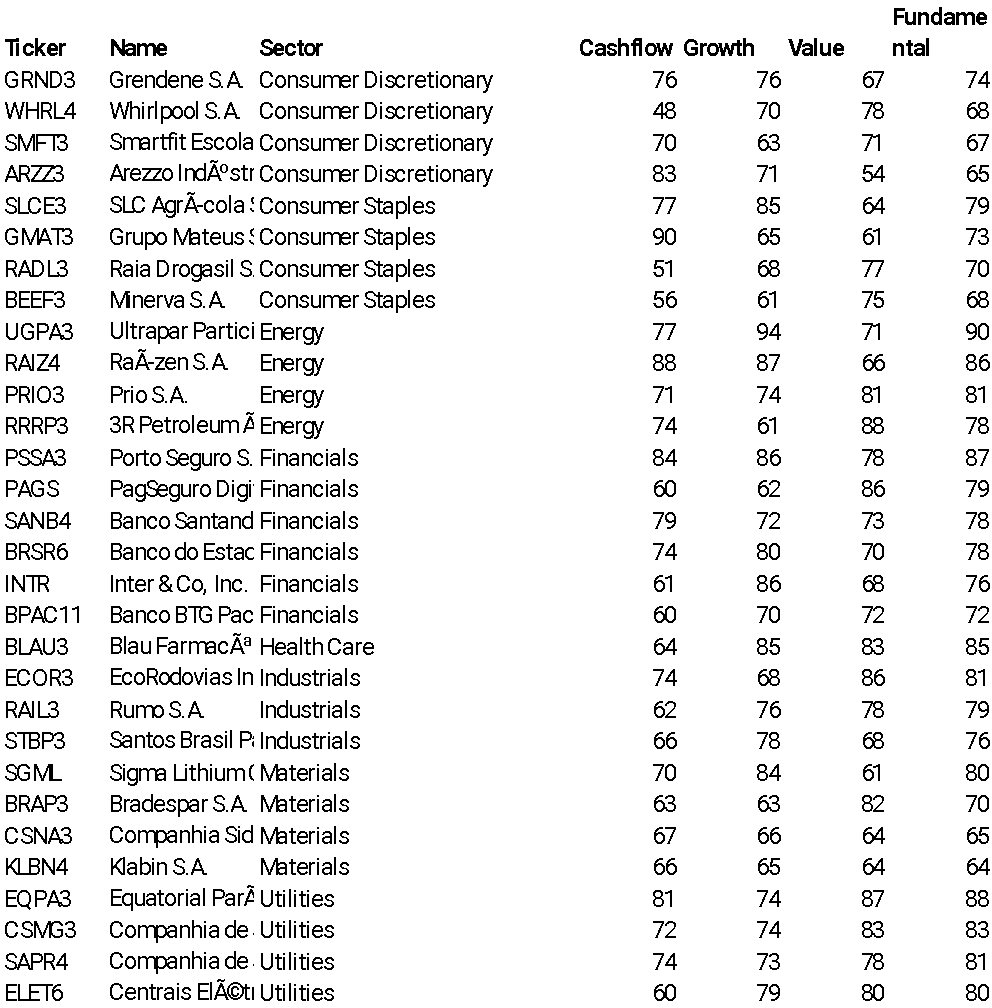

Brazil Bridgewise model portfolio

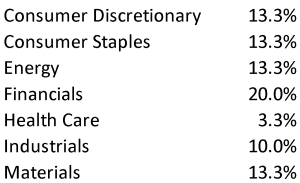

The portfolio is diversified from a sector perspective, with the most represented sector being the financial one, with 20% weight.

The portfolio is skewed to small and mid cap considering an average market cap of $5.5 billion. It is trading at a forward P/E of 11 times and the company set has an average ROE of 16%.

The fuel distribution sector presents an intriguing landscape, notably with key players such as Ultrapar and Raizen exhibiting commendable performance. Operating gas stations under the Ipiranga and Shell brands, both entities have garnered impressive fundamental scores, reflecting robust value, growth, and cash flow metrics. Similarly, Porto Seguro, an insurance company, distinguishes itself with notable high scores. Additionally, noteworthy performers in terms of fundamental scores include toll road operator Ecorodovias and lithium manufacturer Sigma Lithium. The farming giant, SLC Agricola has an outstanding Growth score, based on fundamental drivers in the past 12 months and Pagseguro, the payments and fintech company, stands out due to its Value score.

Bridgewise Brazil model portfolio – holdings and AI scores –