3 Ways AI Is Changing Real-time Investment Decisions

With investors, the difference between making money, or losing it, can be a matter of minutes. Today’s ...

In this data report, we explore key ETFs trends, including the journey from their inception to becoming a dominant force in the investment world. Discover the driving factors behind their explosive growth, learn about the different types of ETFs, and gain insights into regional trends and best practices. We’ll also highlight the risks and rewards of ETFs and provide guidance on how to leverage them effectively. Read the full report to uncover how ETFs are reshaping modern investment strategies.

Exchange-Traded Funds (ETFs) have revolutionized the investment landscape, offering unparalleled access and flexibility to investors worldwide. What began as a niche financial product in the early 1990s has grown into a mainstream investment option with over 12,000 products listed globally, managed by 752 providers across 80 exchanges.

ETFs are now a cornerstone of modern investment strategies. Their simplicity and efficiency make them a preferred choice for both institutional and retail investors. From offering broad market exposure to enabling thematic and ESG-focused investing, ETFs cater to diverse financial goals and preferences. Understanding their evolution, benefits, and risks is essential for making informed investment decisions.

The journey of ETFs began in 1990 with the launch of the world’s first ETF in Canada. Three years later, the U.S. introduced its first ETF, the SPDR S&P 500 ETF (SPY), which remains one of the most traded ETFs today. By the early 2000s, Europe joined the ETF market, and since then, the industry has grown exponentially. In 2024, the total assets under management (AUM) in ETFs reached a record $12.89 trillion, with consistent net inflows for 60 consecutive months.

Several factors have fueled the rise of ETFs:

Understanding the various types of ETFs can help investors choose products that align with their objectives:

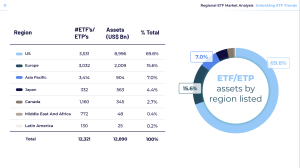

ETFs have seen varying levels of adoption across regions:

Selecting the right ETF involves:

ETF/ETP assets by region

While ETFs offer numerous advantages, they come with potential risks:

ETFs provide diversification but may dilute exposure to high-performing individual stocks. For hands-on investors, direct investments in individual assets could yield higher returns, though they come with increased risk and complexity.

ETFs have transformed the investment landscape, offering accessible, cost-effective, and diversified solutions. However, understanding their structures, benefits, and risks is key to leveraging them effectively. Whether you are an institutional or retail investor, ETFs can serve as a versatile tool for achieving a wide range of financial objectives.

With investors, the difference between making money, or losing it, can be a matter of minutes. Today’s ...

When we first launched Bridget™ , our AI chat solution for investment insights, it represented a ...