Investment Intelligence for Funds: Deep Mutual Fund and ETF Analysis with Fundwise

Mutual Funds have long been one of the most popular choices for investors, and alongside ...

Provide investors with regulatory-compliant recommendations for over 12,000 funds worldwide.

Capitalize on the rising interest in fund investments with a tool offering recommendations for 12,000+ funds and interactive comparisons in multiple languages. Unique holdings drive the exploration of diverse asset classes and increase trading activity.

Empower advisors to enhance client service around funds with an intelligence tool offering regulatory-compliant recommendations for 12,000 global ETFs and mutual funds, multilingual rationales, and unique holdings insights

Provide investors with recommendations for 12,000 funds worldwide, offering multilingual support and rationale to enhance decision-making.

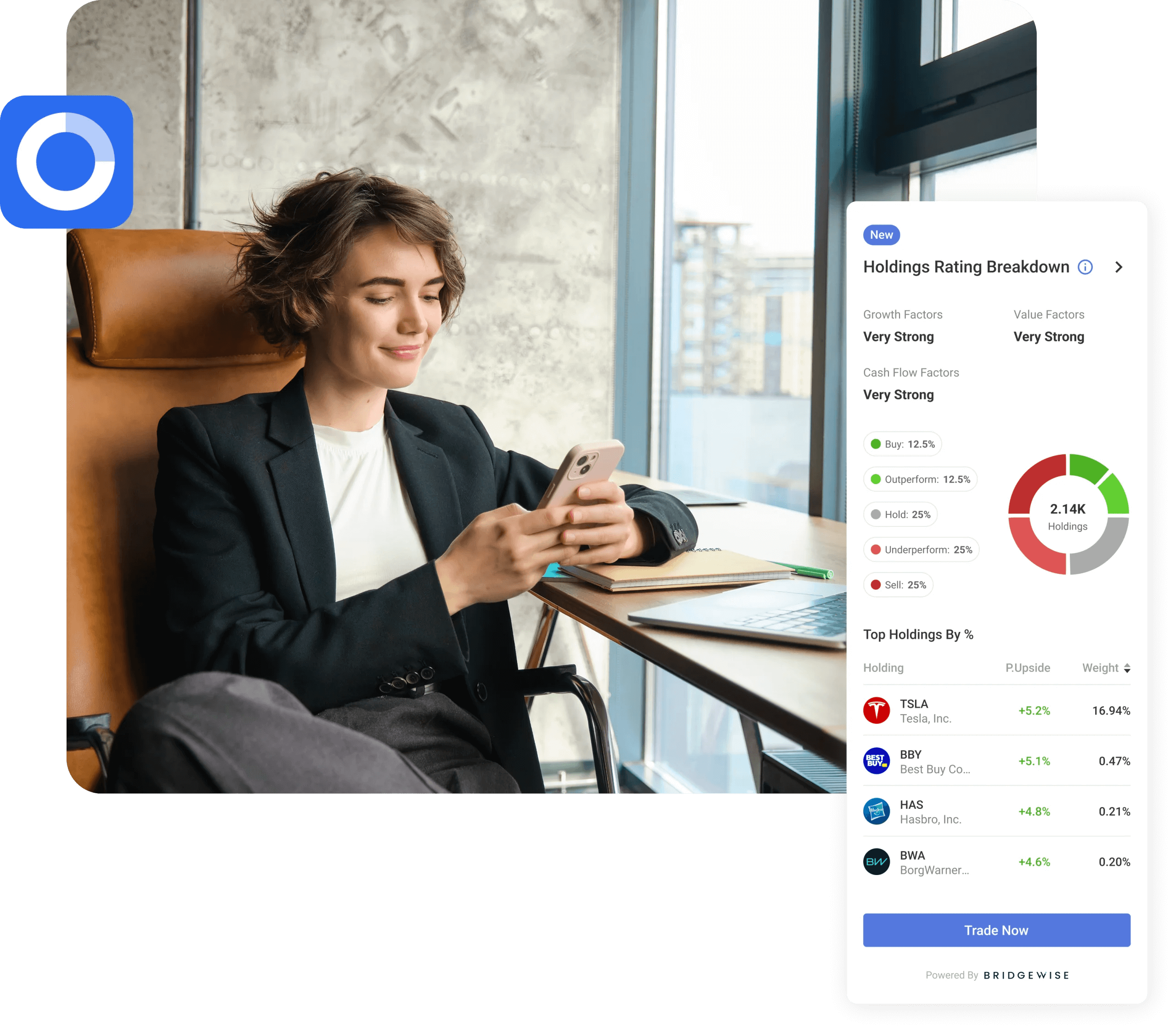

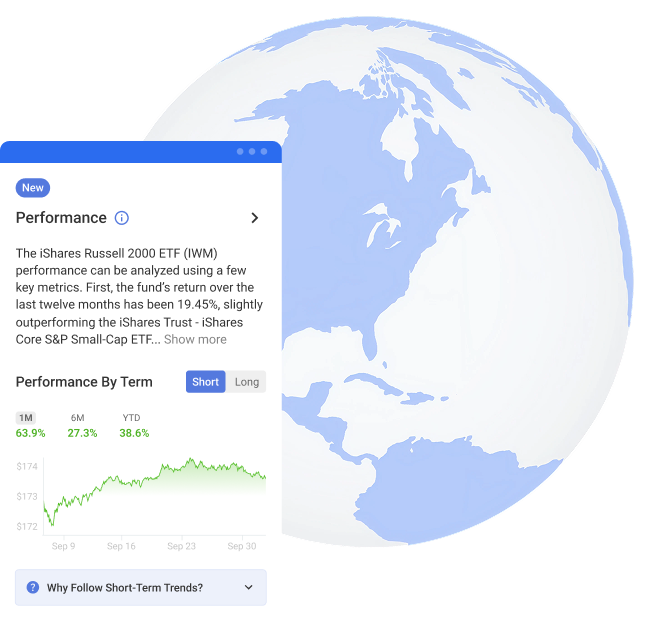

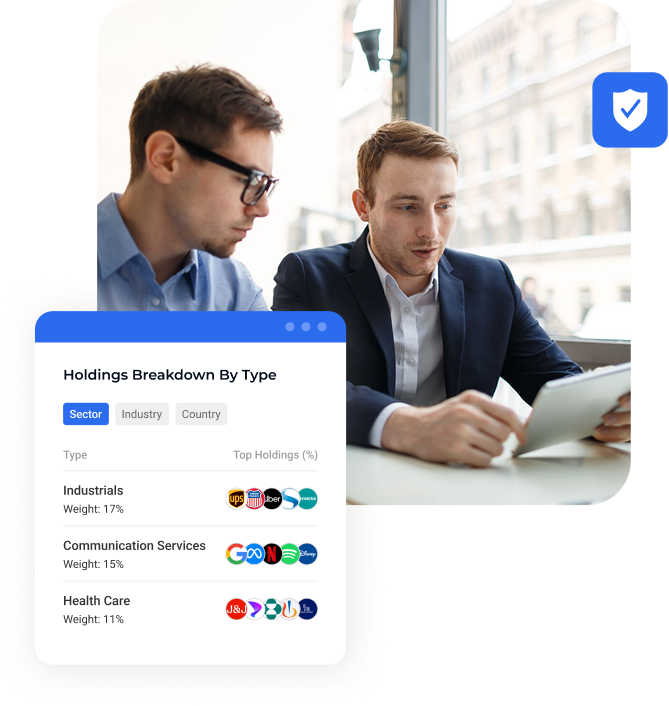

Deliver in-depth insights into the performance of funds by analyzing their underlying assets, ensuring a clear and comprehensive view of fund health and highlights.

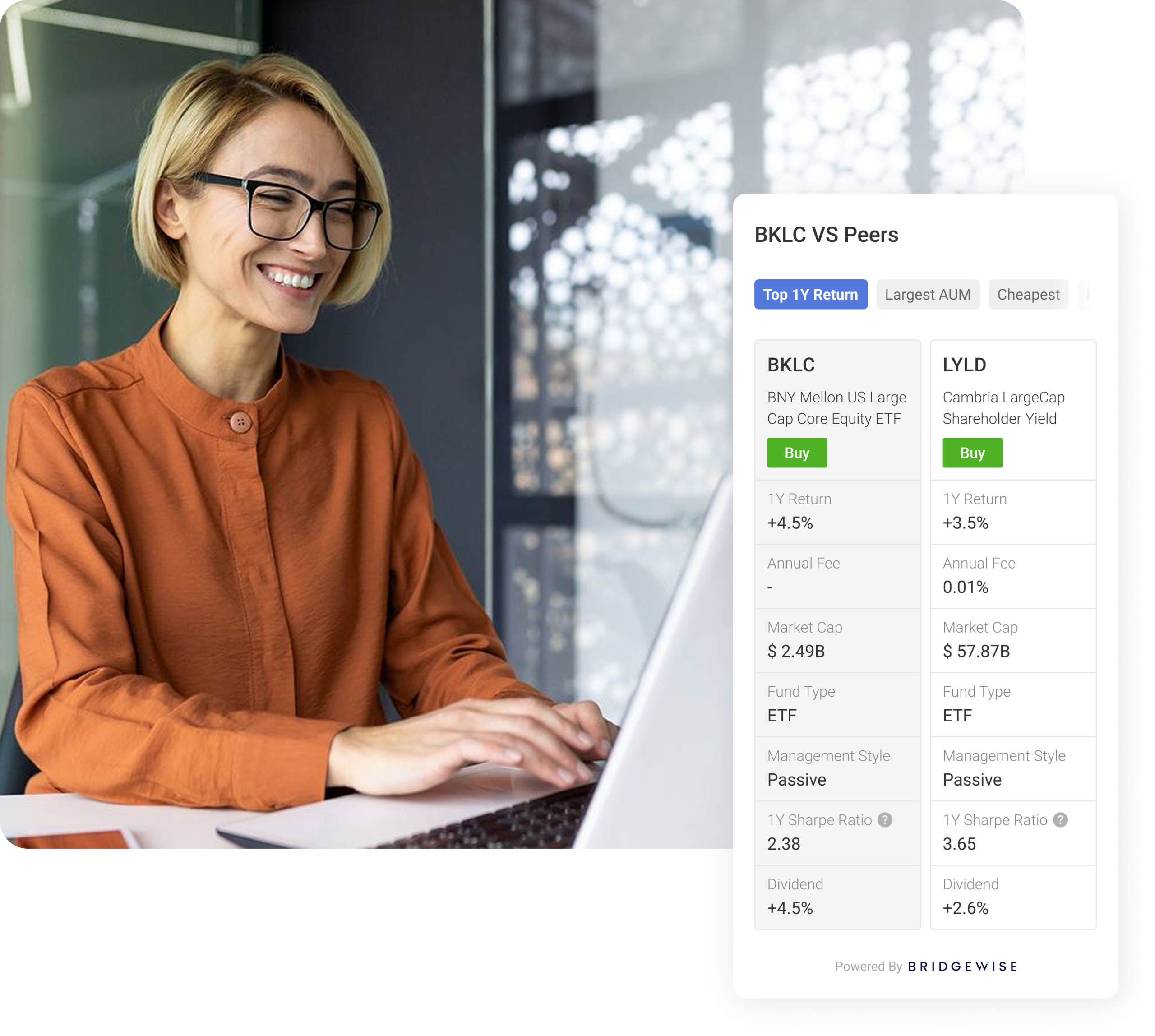

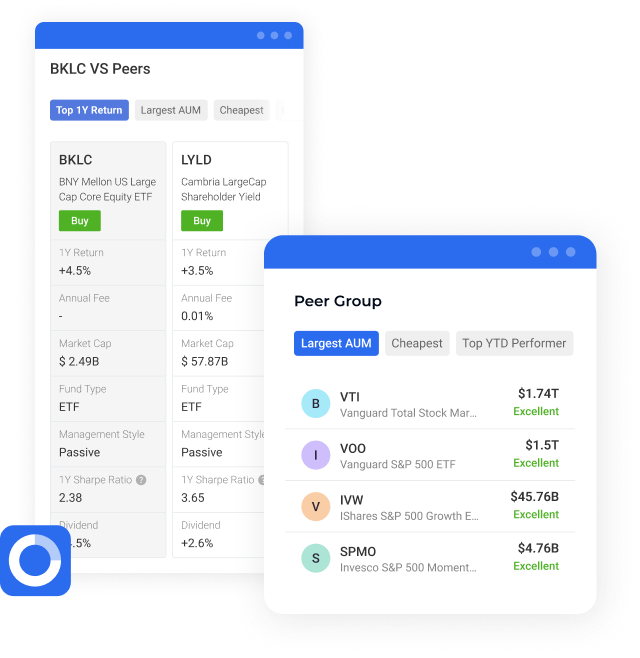

Enable interactive comparisons across various factors, with graded metrics against industry averages, allowing investors to easily evaluate and choose between alternative funds, whether active or passive.

Give investors the confidence they need with a tool that is compliant with regulatory standards. Ensure it aligns with your specific policies by customizing everything from coverage to the user interface.

Bottom-up fund analysis evaluates individual holdings within a fund to determine how they drive overall performance, rather than focusing solely on broader market trends or sector movements.

FundWise simplifies fund selection by offering recommendations for 12,000+ global funds, interactive comparisons, and graded insights against industry benchmarks, helping investors make informed decisions with confidence.

FundWise is built on advanced AI-driven analytics, utilizing deep fundamental data, historical performance trends, and proprietary holdings analysis to deliver transparent, data-backed fund intelligence.

Peer-to-peer fund analysis compares a fund’s performance, risk factors, and composition against similar funds in the same category or benchmark, providing investors with a clear perspective on its competitive positioning.

FundWise provides a side-by-side comparison of active and passive funds, highlighting performance trends, cost efficiency, and underlying holdings, allowing investors to make the right choice based on their investment strategy.

Yes, FundWise is designed to ensure full regulatory compliance, adapting to regional regulations and financial institution policies to provide accurate, transparent, and legally compliant fund insights.