Bridgewise Brings the Olympic Spirit to The Capital Markets

Tomorrow, athletes from all over the world will gather in Paris as the 2024 Summer Olympics begins with ...

In times of geopolitical shifts, Mexico has the potential to increase its share and position in global trade and manufacturing. This is due to the nearshoring trend seen in recent years. Nearshoring occurs when a company moves part or all of its production closer to its final consumer.

The nearshoring trend gained momentum in recent years due to several factors including:

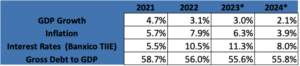

Looking at Mexico’s macro environment, the expected scenario is stable considering modest growth coupled with low indebtedness levels. Due to its tight monetary policy (led by global macro conditions) and its success in curbing inflation, real rates are high and attractive for fixed-income investors.

Nearshoring has the potential to boost Mexico’s GDP growth over the next few years through increased Foreign Direct Investments, a boost to exports, and increased employment opportunities.

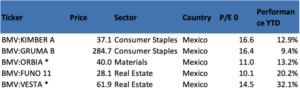

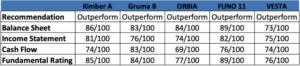

Mexico’s equities market also has the potential to benefit from a potential nearshoring growth boost. A successful implementation will create increased investment and growth opportunities for the stocks traded in the Mexican Stock Exchange (BMV). Among the companies that scored the highest by Bridgewise:

FUNO and Vesta of Mexico’s real estate sector are clear beneficiaries of nearshoring due to increased demand for commercial real estate. Vesta develops, manages, operates, and leases industrial and distribution centers. Vesta serves many large clients, such as BMW, Nestlé, Kimberly-Clark de México, Kraft, and others. FUNO is one of Latin America’s largest REITs offering a dividend yield of close to 10%. The company has a diversified commercial real estate portfolio.

ORBIA is a Mexican chemical manufacturing company producing polymer solutions, building and infrastructure, precision agriculture, connectivity solutions, and fluorinated solutions. The company is well positioned to benefit from increased Foreign Direct Investments expected to flow into Mexico.

Kimberly Clark De Mexico and Gruma are stable staples companies in the food and personal care segments. Their expected growth is directly linked to Mexico’s GDP assumptions. Kimberly Clark De Mexico owns brands such as Huggies, Kleenex, Kotex, and more in Mexico. GRUMA is a Mexican multinational food company, leading the world in corn masa flour, tortilla, and wrap production. The corporation also produces a variety of other foods, such as flatbreads, rice, beans, snacks, pasta, oats, sauces, and taco shells, among others.

Tomorrow, athletes from all over the world will gather in Paris as the 2024 Summer Olympics begins with ...